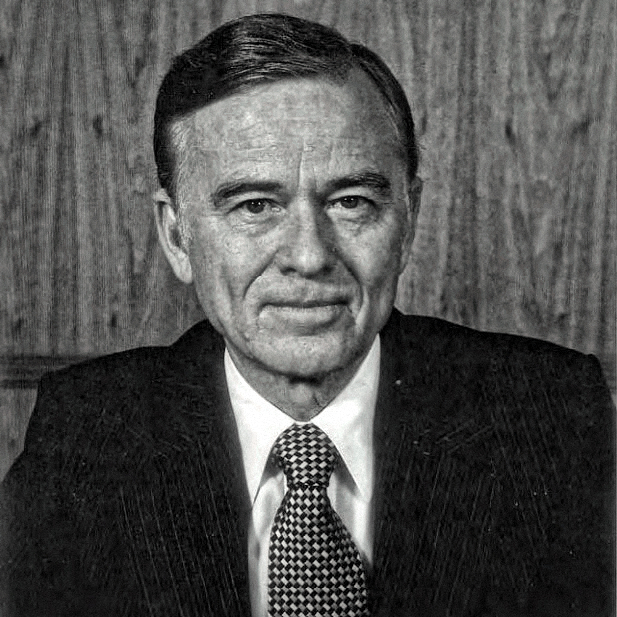

Several years ago, in a special audio program, John Mihaljevic reviewed the life and times of Henry Singleton, founder of Teledyne. Singleton is highly regarded for his long term-oriented, independent-minded approach to shareholder value creation.

printable transcript download audio listen as podcast

We are pleased to share the following transcript with you. The transcript has been edited for space and clarity. The narrative relies on George Roberts’ Distant Force and other sources. Quotation marks are used to denote direct quotations from third-party sources, though in some instances quotations may not be marked but should be apparent from the overall context.

Henry Singleton was one of the most brilliant engineers and businessmen of the twentieth century. We will look at a book on Mr. Singleton entitled Distant Force, authored by George Roberts, a long-time business associate and president of Teledyne Corp, which Singleton founded.

First, we’re going to survey a few articles on Henry Singleton and give you an overview of his life before going through some of the most interesting passages of the biography by George Roberts. In a New York Times obituary in 1999, the year of Mr. Singleton’s death, Leon Cooperman of Omega Advisors is quoted as saying that Singleton understood how to move between real assets and financial assets in a way you don’t see today. “He was the most brilliant industrialist that I’ve ever met and I’ve met many,” said Mr. Cooperman.

Singleton was said to have an ability to recite lengthy passages from Shakespeare and other poets, and he liked to play chess without looking at the board, keeping the positions of the pieces in his head.

Quoting Arthur Rock, a venture capitalist who provided the initial financing for Teledyne and served on its board for 33 years, Singleton didn’t care what other people thought. His style was to stay in his office and to think things up, and to get other people to carry them out.

Singleton was not only a businessman but also a scientist. He invented a method for degaussing submarines, which allowed American submarines to go by German submarines without being detected. He has many patents to his name and was respected in scientific circles.

Here’s a comment by Bill Nygren, fund manager of the Oakmark Fund. In a 2002 letter to investors Nygren says that in 1960, “Henry Singleton founded Teledyne, a company that grew rapidly for a decade via a combination of internal growth and acquisitions. When the opportunities for value added acquisitions disappeared, Singleton switched gears. From 1970 to 1984 he used his cash to repurchase 82% of Teledyne’s grossly undervalued common shares. As a result, the stock price increased from $2 to $250.” Singleton, says Nygren, was a pioneer of maximizing shareholder value by shrinking the business. Quite an interesting concept.

A key to Singleton’s success in creating shareholder value was his ability to reduce the share count and not worry as much about growing the size of Teledyne as about growing value on a per-share basis. In The Money Masters, John Train quotes Buffett as saying that, “the failure of business schools to study men like Singleton is a crime. Instead, business schools hold up as models executives cut from a McKinsey & Co. cookie cutter.”

Buffett wrote in a letter to shareholders in 1980, “if a fine business is selling in the marketplace for far less than its intrinsic value, what more profitable utilization of capital can there be than significant enlargement of the interest of all owners at that bargain price.” Berkshire had not pursued that avenue until fairly recently because Buffett felt most of the time that he could deploy capital in other businesses. Buffett has taken the view that Berkshire shareholders should be holders for the long term, and that he’d prefer not to enrich one group of shareholders, presumably the ones staying with the company, at the expense of another group, presumably those who would be selling at a low price if Berkshire bought back shares.

John Train also quotes Buffett as saying that Henry Singleton has the best operating and capital deployment record in American business. That’s quite a statement.

Many stories were not complimentary of Singleton. A story in Businessweek in 1982 blasted him for buybacks. That story, having been written just before the great bull market, could not have come at a worse time for Businessweek because the buybacks Singleton executed proved to be extremely prescient.

One of the things Singleton believed was engaging an uncertain world with a flexible mind. Singleton is quoted as saying, “I know a lot of people have very strong and definite plans they’ve worked out on all kinds of things, but we’re subject to a tremendous number of outside influences and the vast majority of them cannot be predicted, so my idea is to stay flexible. My only plan is to keep coming to work every day.”

This improvisational grand design Businessweek magazine saw as the milking of tried and true operating businesses and the diverting of funds to allow the Chairman to “play the stock market.” Obviously, this criticism is not warranted but it’s something pointed out in an article in the New York Observer in 2003. That article also goes on to say that Singleton’s reserve was icy. His disdain for the press was complete and thoroughgoing. The Businessweek article just rolled off his back. It puzzled him that his friend Leon Cooperman would bother to draft a nine-page rebuttal, complete with statistical exhibits. Why go through the trouble, Singleton might have said.

Another point that the Businessweek article failed to raise was under what circumstances the buybacks Teledyne was making occurred. There’s a stark contrast between companies doping repurchases when their executives are selling stock and companies repurchasing stock simply for the benefit of continuing shareholders.

Singleton never sold a single share of Teledyne, so the share repurchases made his percentage stake in the company grow over time. This contrasts with many companies that have come to be large repurchasers of stock in recent years, often at prices above intrinsic value.

An infamous example is Countrywide Financial, which spent nearly $2 billion on stock buybacks over two years. Subsequently, its stock lost more than 75% of its value. While the buybacks were occurring, Countrywide CEO Angelo Mozilo was selling shares. That would have been antithetical to a Henry Singleton.

Let’s look at an article on Singleton published in Forbes Magazine in 1979. The article describes him as the aloof son of a well-to-do Texas ranger. This is noteworthy in two respects – for the size and quality of the company he built from scratch, and for his almost arrogant scorn for conventional business practices. The article goes on to say that what distinguishes Teledyne beyond its position on various lists is that during a period when inflation eroded corporate profit margins, a period when corporations sold more and enjoyed less, Teledyne’s profitability was growing, not shrinking. The article was written after a period of rampant inflation in the U.S.

Singleton had spent three years at Annapolis, then switched to the Massachusetts Institute of Technology, where he earned his Bachelor’s, Master’s, and Doctorate of Science in electrical engineering. This reminds me a bit of John Malone of Liberty who went to Yale, a liberal arts school, and yet Malone studied science there and has gone on to greatness in business.

Singleton was educated as a scientist, not a businessman. He did not leap into entrepreneurship but trained for it over decades at the best schools of practical management in the U.S., first as a scientist at General Electric, then as a management man at Hughes Aircraft. Then in the early days at Litton Industries when founder Tex Thornton and Roy Ash were building one of the first truly “hot” companies of the post-World War II era. Not until 1960, when he was 43, did Singleton found Teledyne.

Several sources observe that Singleton was supremely indifferent to criticism. In the early 1970s, when investors and brokers alike lost their original enthusiasm and deserted the shares, Singleton had Teledyne buy up its own stock. As each tender offer was oversubscribed by investors of little faith, Singleton took every share.

When Wall Street, indeed even his own Directors, urged him to ease up, he kept right on buying. Between October 1972 and February 1976, he reduced Teledyne’s share count by 64%, from 32 million shares to 11.4 million.

The Forbes article has a remarkable statement by Singleton: “I don’t believe all this nonsense about market timing. Just buy very good value, and when the market is ready, that value will be recognized.” This is an interesting statement by Singleton on market timing because one can obviously look at his repurchases of stock at low prices and issuance of stock when it was highly-priced to make acquisitions as nothing other than market timing.

Singleton did not view it that way. He never operated with a compass that said, how can we time the stock price? Is the stock going to go up or down? He operated with a mindset that, if we’re buying the stock when it’s undervalued, it’ll go up at some point. And if we are making acquisitions using currency that may be overvalued because Wall Street is too optimistic, we might be getting a good deal. Sometimes when investors are able to acquire assets at below their intrinsic worth, in hindsight it will look like good market timing when in fact no market timing was attempted.

Let’s quote more from the Forbes article in 1979: Most impressive is that Teledyne’s capital shrinkage was not achieved at the expense of growth or by partially liquidating the company. All during these years, Teledyne kept growing where in its early years it had grown through acquisitions, 145 in all. In its capitalization-shrinking days, Teledyne grew from within and steadily.

In 1970, when acquisitions had ceased, revenues were $1.2 billion. In 1974, $1.7 billion. In 1976, $1.9 billion, and so on. In 1979, Teledyne was on track to generate $2.6 billion. Yet in the years sales more than doubled from $1.2 billion, Teledyne made only one minor acquisition and did not get deeply into debt.

In the early stages of his stock-buying program, Singleton did have Teledyne borrow rather heavily, but he paid down the debt out of cash flow. When investors, disillusioned with growth, became dividend-conscious, Teledyne refused to pay a dividend. “The second highest-priced stock on the Board after Superior Oil, Teledyne’s cash yield is zero,” according to the Forbes article. In the late 1970s, large companies were expected to pay a nice dividend. Equities, to some extent, were valued on yield. Perhaps one of the reasons Teledyne’s stock price may have swung so wildly is there was no dividend, and the shares didn’t have something tangible (a dividend yield) that would help investors peg the price of the stock. This turned out to be of great advantage to Teledyne’s long-term shareholders because it allowed Singleton to buy the shares when they got too cheap and to issue stock when it got ahead of itself.

Let’s put Singleton in perspective. During the time he all but ignored Wall Street, many of America’s top executives were trimming their sails to Wall Street’s changing winds. The Forbes article cites a few interesting examples: In 1974, Textron Chairman William Miller wanted to go after troubled Lockheed. His shareholders would have been delighted with this, but analysts questioned the proposed action and Miller backed away. Textron would have had an opportunity to get a big chunk of Lockheed stock at $3 per share. Only five years later, it was selling at $21 per share. By giving in to Wall Street analyst demands, Textron was worse off.

Another example is American Express attempting a tender offer for McGraw-Hill. It would have been a good deal, but AmEx Chairman James Robinson III ultimately backed off because of resistance on the Street.

In 1968, Xerox, which traded at a P/E of 53x, was about to merge with CIT Financial, a major company trading at a much lower multiple. This would have been an accretive deal for Xerox. They could have done it in stock. But investment analysts questioned the deal: why dilute a high-tech stock with a grubby money-lending business? Ultimately, Xerox Chairman Peter McColough retreated and instead blew $920 million for Scientific Data Systems, a fledgling computer company. Instead of making a great deal, Xerox ended up making a bad deal.

According to Forbes, “it would be hard to picture Henry Singleton trying an unfriendly takeover, but it would be harder to picture him backing away as American Express did once he had made an offer. It would be inconceivable for him to back away from the Lockheed deal or the CIT deal just because the brokerage fraternity disapproved. He kept buying up his own stock with both hands when the Street called him crazy.” The article continues, “we have not even mentioned what Teledyne makes or sells. That’s because what Teledyne makes or sells is less important than the style of the man who runs it. The fact is that Singleton unashamedly runs a conglomerate. What are the products and services upon which Singleton has put his stamp? Offshore drilling units, auto parts, specialty metals, machine tools, electronic components, engines, high-fidelity speakers, unmanned aircraft, and Waterpik home appliances.”

Evident to me is that for Singleton it all did come down to financial return. That’s what a lot of CEOs forget these days. They think their company is in a particular business and it’s destined to be in that business forever. Whatever free cash flow the business throws off is mindlessly reinvested in that business, when the purpose of a company is to maximize value for shareholders. A company does not have an obligation to stay in a business that’s failing, or whose margins are shrinking, or whose returns on capital are insufficient to justify continued reinvestment. Unfortunately, a lot of CEOs forget that.

The Forbes article goes on to mention Singleton’s partner George Roberts: “Singleton works closely with his president George Roberts who has his Doctorate from Carnegie Mellon in Metallurgy. Roberts is the Chief Operating Officer, and an extremely effective one. This is not the kind of conglomerate where headquarters staff only loosely supervises a number of good-sized semi-independent operations. Taking a leaf from Harold Geneen’s book, Teledyne has super-tight financial controls. Taking a leaf from 3M’s corporate books, it breaks up a huge business into a cornucopia of small profit centers, 129 in Teledyne’s case. So far in 1979,” writes Forbes, “all 129 of those are profitable.”

George Roberts, Singleton’s partner, goes on to say, “Forget products. Here’s the key: We create an attitude toward having high margins. In our system, a company can grow rapidly and its manager can be rewarded richly for that growth if he has high margins. If he has low margins, it’s hard to get capital from Henry and me. Our people look and understand, having high margins gets to be the thing to do. No one likes to have trouble getting new money.” It is interesting that Roberts focuses on margins and not return on capital. Obviously, the two are highly correlated, but it’s an interesting distinction that, for Roberts anyway, margins were the thing that made a business “good”.

Roberts also says, “The only way you can make money in some businesses is by not entering them.” That’s another statement CEOs should heed. The airline industry comes to mind. Buffett observed some years ago that the airline industry since inception had a cumulative loss. According to him, it would have been better for society if the airline industry had never come into being. [Ed. note: Perhaps ironically, perhaps reflecting the flexibility and growth of Buffett’s mind, Berkshire subsequently invested in airlines.]

The takeaway for individual companies is that sometimes the best thing to do is nothing — to preserve capital for when it can be deployed in a rewarding way.

Forbes also states that Singleton has an intellectual and old-fashioned respect for cash instead of bookkeeping profits. You can’t pay bills with bookkeeping profits. Fairholme fund manager Bruce Berkowitz comes to mind in this context because he has said repeatedly that cash is the only thing you can spend, and that’s why Berkowitz focuses on the free cash flow of his investee companies. [Ed. note: Berkowitz did invest in and hold onto shares of Sears Holdings even as Sears was bleeding cash.]

Let’s look at value creation from a string of acquisitions, how value was created when Singleton used stock to buy companies. Subsequent to that, when his own stock became cheap after the conglomerate crash of 1969, Singleton went in and bought enough of it to shrink the capitalization back to where it was when Teledyne had been a much smaller company. It was as though he had been able to renegotiate his earlier acquisitions at a fraction of the original prices.

If one can use stock as currency at inflated prices to acquire businesses that are fairly priced or even underpriced, and then one’s own shares decline, as they inevitably do simply due to market volatility, companies could actually “renegotiate” their earlier acquisition purchase prices by buying back their own stock, thereby eliminating the shares issued in previous deals.

Singleton was thrust into the role of “portfolio manager” at Teledyne by accident. It might never have happened, Singleton told Forbes, if Teledyne’s Argonaut Insurance subsidiary had not gone into trouble writing medical malpractice insurance in 1974. Singleton said, “The idea of indexing isn’t something I believe in or would follow.” He said this with scorn — quite amazing, considering that this statement was made in the 1970s, way before indexing had reached the extent to which it is used today.

Here’s how Singleton chose stocks for the portfolios of Teledyne’s insurance subsidiaries: He decided to buy companies he felt were well-run and undervalued. His biggest move was to put $130+ million, or 25% of the equity portfolio, into Litton, a company he had known for a long time. Said Singleton, “It’s good to buy a large company with fine businesses when the price is beaten down over worries about one problem. Litton’s problem was not a general one but an isolated problem, as ours was with Argonaut Insurance. To me, it was hard to believe the heads of a $3 or $4 billion business would not be able to handle one business problem.”

This is quite an interesting statement about investing and security selection. Buffett has talked about this as well when discussing his purchase of American Express back in the days of the Salad Oil scandal, when a single issue unrelated to AmEx’s business franchise, had depressed the stock so much that Buffett saw it as a phenomenal opportunity to acquire a quality business that was being rocked by one issue that ultimately would not impair the value of the entire franchise. As investors, we all may want to look for opportunities to pick up good businesses when there’s an issue that scares the market at large.

Singleton also bought many insurance company stocks for the portfolio, insurance being a business Singleton knew well. He also bought blocks of oil stocks and had good gains in those. Teledyne companies did geological exploration and made drilling rigs. Singleton was choosing a field he understood well in which to make investments in public securities.

Here’s Singleton’s reasoning on the subject of tenders: “In this climate where tender offers mean overpaying, I prefer to buy pieces of other companies, or our own stock, or expand from within. The price for buying an entire company is too much. Tendering at the premiums required today would hurt, not help, our return on equity, so we won’t do it.” Singleton also said, “Why pay ten times earnings in a tender for a company when I can buy pieces of companies for six times earnings and my own stock for five times earnings?” This again goes to his view on allocating capital to where that capital can go into the most undervalued assets. He was not an empire builder. He was interested in value creation on a per-share basis.

Singleton says he wouldn’t sell any of his blocks to would-be acquisitors. This is regarding some of the large positions in marketable securities that Teledyne held such as Litton. There was a lot of speculation at the time that Singleton was acquiring large blocks to either then make a bid for companies himself or obviously that he might sell out at a premium to would-be raiders.

Singleton, however, remained a friendly acquirer and ultimately that was to his benefit. That’s another parallel to Warren Buffett who also has gone to painstaking lengths to make sure that companies know he’s a friendly investor rather than a potential threat.

Here’s more on dividends that Teledyne didn’t pay. Forbes in 1979 says, “a few years ago when Teledyne’s stock was selling around ten, one of Singleton’s closest associates begged him to pay at least a token dividend. Singleton refused. He still refuses.

To begin with, he asks, what would the stockholder do with the money? Spend it? Teledyne is not an income stock. Reinvest it? Since Teledyne earns 33% on equity, he argues he can reinvest it better for them than they could for themselves. Besides the profits have already been taxed, paid out as dividends they get taxed the second time. Why subject the stockholder’s money to double taxation?”

What is Henry Singleton’s own sense of economic reality? “At a time when many top businessmen are gloomy about the future of the country, this is Forbes speaking in 1979, Singleton has this to say – I’m convinced the coming recession will not be too deep or long and we’ll have a good recovery following it.

It is so fashionable to complain about the restrictive regulatory environment in Washington that makes people forget how very much worse things could be. Long run, I’m happy about the prospects for America, for business and for Teledyne.” While this was a statement Singleton made in 1979, it’s something that could be echoed today in 2009 and it’s essentially what Warren Buffett has been saying ever since late 2008 when investors got concerned about the outlook. Some thought the world was coming to an end and yet as Singleton pointed out thirty years ago, that same sentiment would have been absolutely the wrong sentiment. And so this is another mark of great investors is that they have an ability to look beyond the now, and imagine what could be, and what will be in the future. And so when the broader market becomes too optimistic, those investors become cautious. And when the market becomes fearful, those investors become more optimistic because they see great values that they can acquire and ride for the long term.

Here’s another quote by Singleton, “I do not define my job in any rigid terms but in terms of having the freedom to do what seems to me to be the best in the best interest of the company at any time.”

This is obviously a very broad statement. And coming from managers without a track record of creating shareholder value, this statement could be frowned upon. But having a Henry Singleton say this is quite interesting because here’s a guy who created value because he was flexible and did not paint himself into a box, or an industry, or accede to the demands of investment analysts.

Let’s turn to the biography by George Roberts entitled Distance Force, by the way, a book that I would highly recommend. It’s available on Amazon.com as well as by the author himself if you do a Google search for George Roberts’ Distant Force.

Roberts actually has some data here on what Singleton really accomplished at Teledyne. An investor who put money into Teledyne’s stock in 1966 achieved an annual return of 18% over 25 years or a 53x return on invested capital versus 7x for the S&P 500, and 9x for General Electric. I believe this is from 1966 to 1993.

Roberts also states in the book, and were going to quote quite a few passages now, “that Singleton believed and often said that the key to his success was people – talented people who were creative, good managers and doers. From the start, he surrounded himself with that kind of person. Henry searched for talented people, went down even to the individual managers of his smallest companies.”

Today, stressing the importance of people is something that all companies do and often it’s just a statement that is meant for PR consumption. But Singleton was not a man prone to hyperbole or making statements simply for PR reasons. So it’s quite notable that he put so much emphasis on the talent of his employees and executives. George Roberts being one of those

And actually the way that Roberts ultimately teamed up with Singleton was in 1966 when Roberts was at Vanadium-Alloy Steel Company in Pennsylvania also known as VASCO. The two friends who had remained in contact over the years agreed that a merger of their companies would be profitable to both. With that merger, George became President of Teledyne with Henry as Teledyne’s Chief Executive Officer and Chairman.

In the book that we’re going to go through over the next half an hour, so Roberts searched his archive of corporate documents to construct a memoir that describes the first decade of aggressive acquisitions and diversification, Henry’s reasons for adding financial institutions to his highly technical mix, his controversial program of aggressive stock buybacks, the spinoff to shareholders of certain entities which greatly broadened their flexibility in handling their investments, and finally the difficult days of hostile takeover attempts that followed Singleton’s retirement from Teledyne.

“Singleton was born a farm boy in Texas. Born on November 27th 1916 on a small ranch in Hayeswood, Texas some twenty miles north of Fort Worth where his father raised cotton and cattle. This early rural background gave him a love of the land and cattle ranching that never left him, and led him in later years to become one of the largest private land owners in the United States.”

Roberts writes that he can attest to Singleton’s lifelong fascination with love of and belief in the importance and value of real estate of all types. “His family, Teledyne and property were clearly the three major loves of his life according to Roberts speaking about Singleton.”

One of Henry’s great talents was mathematics. “At the academy, this is the Naval Academy at Annapolis, an initial intense two-year program of mathematics covered what would normally be done in three or four years at the average college. At the end of those first two years, Henry ranked first in mathematics in our class of 820 students.”

Let’s see what Roberts writes about the beginnings of Teledyne. “Henry had three great ideas in creating and growing Teledyne. His first was to recognize the future importance of digital semiconductor electronics when this technology was in its infancy and by selective acquisitions to create a strong base in this growing field on which to diversify his company.

The second was to acquire and organize a selection of financial companies within his company to provide a strong financial base which also allowed the rest of the financial world to recognize Teledyne as an important entity and potential client.

The third was his innovative use of stock buybacks to further strengthen the corporation and enhance shareholder value.

Sales of Teledyne in 1961, the first full year of operation, were 4.5 million with a net income of 58,000 and a per share income of ¢13. By the end of the second fiscal year in October 1962, Teledyne’s sales had reach 10.4 million with a net income of 331,000.”

In making many of the acquisitions that Teledyne made, Robert says, “Henry depended on several very talented management people to survey the field for possible acquisitions and evaluate them as to their technology, management history and markets, and desirability as Teledyne properties.

Henry, however, made the final decisions based on his judgment as to their value, suitability and potential profitability, as well as their fit into the rapidly expanding family of Teledyne companies.

One of these men was Claude Shannon who was a good friend of Henry’s from his days at MIT and was a Director of the company for many years. He also played a valuable part in helping Henry evaluate many of Teledyne’s important acquisitions.” This is notable because Claude Shannon is a famous scientist of the twentieth century. In fact, there’s quite a bit written on him in William Poundstone’s excellent book Fortune’s Formula. Writes Poundstone, there are a few sure things least of all in the competitive world of academic recruitment, Claude Shannon was as close to a sure thing as existed that is why MIT was prepared to do what was necessary to lure Shannon away from AT&T’s Bell Labs and why the institute was delighted when Shannon became a visiting professor in 1956.

Shannon had done what practically no one else had done since the renaissance. He had single-handedly invented an important new science. Shannon’s information theory is an abstract science of communication that lies behind computers, the internet and all digital media.

It’s said that it is one of the few times in history where somebody founded the field, asked the right questions and proved most of them, and answered them all at once, was noted by Cornell’s Toby Berger.

So here’s somebody, Claude Shannon, who in terms of scientific accomplishment perhaps even exceeded Singleton himself. But this is the kind of man that Singleton attracted as a Director of Teledyne and someone to help him with acquisitions. Shannon was also an investor himself, and in Fortune’s Formula, Poundstone writes that in the late 1950s, Shannon began an intensive study of the stock market that was motivated both by intellectual curiosity and desire for gain.

He filled three library shelves with something like a hundred books on economics and investing. The titles included Adam Smith’s The Wealth of Nations, John von Neumann and Oskar Morgenstern’s Theory of Games and Economic Behavior, and Paul Samuelson’s Economics, as well as books with a more practical focus on investment. One book Shannon singled out as a favorite was Fred Schwed’s wry classic Where are the Customers’ Yachts?

At the time, Shannon was designing the roulette computer with Thorp. Shannon kept notes in an MIT notebook. A part of the notebook is devoted to the roulette device and part to a wildly disconnected set of stock market musings. Shannon wondered about the statistical structure of the market’s random walk and whether information theory could provide useful insights.

He mentions such diverse names as Bachelier, Graham and Dodd, Magee, A.W. Jones, Morgenstern and Mandelbrot. He considered margin trading and short selling, stop-loss orders, and the effects of market panics, capital gains, taxes and transaction costs.

Shannon graphs a short interest in Litton Industries – shorted shares versus price. The values jump all over with no evident pattern. He knows such success stories as Bernard Baruch, the lone wolf, who ran $10,000 into $1 million in about ten years. And Hetty Green, the Witch of Wall Street, who ran $1 million into $100 million in thirty years. As we’ll learn, Singleton’s record was quite remarkable as well.

As background to Teledyne’s acquisition period writes Roberts it is interesting to consider what was happening in that decade of the 1960s. During and after the end of World War II, there were all sorts of emerging new technologies, new ideas, new markets and new opportunities that hadn’t existed before the war.

There were many opportunities for small new companies to go into business during the war to provide the diverse products needed for the war effort, and many did so successfully. In addition to this, many veterans came out of military services at the war’s end and through the GI Bill had an opportunity to get tuition-free educations in some of the most prestigious universities and schools in the country.

They learned technologies they might never have had an opportunity to learn otherwise. They studied basic science skills such as physics, chemistry and mathematics, and also specialized technologies such as electronics, metallurgy, geophysics, oceanography and others. And some of these men and women used their new knowledge to start companies often on just a shoestring with their own family money.

By the 1960s, many of these companies had matured into established profitable companies and many of their owners were ready to relinquish, control, and do other things with their lives or they had reached the point where they needed more capital to continue to develop and were looking for ways to do that.

Then along came a company such as Teledyne with a high P/E ratio that was growing rapidly and was interested in acquiring them. It was a wonderful opportunity for these people, writes Roberts, and many of the companies that Teledyne acquired were this type of family-owned company.

On a September 1967 interview with Forbes magazine, Henry Singleton said “we have what is called a management inventory. We work our heads off to increase our own capability at collecting and promoting the right people. To the extent we succeed, the whole company will succeed. We increase our bets on the men who seem to be performers.

We try to get all our people instead of competing amongst each other within Teledyne to look outside and see that the real competitors are all the other large corporations in the U.S. Our objective is to increase our rate of earnings faster than they do. It is a lot of fun. As a result, we visualize it as a competitive game.”

It’s been observed many times that the best managers and the best investment managers for that matter view what they do as a game. They love the challenge that it presents, the competition, and they excel at that. That’s a common trait that one will encounter with many of the best managers.

In 1963, Teledyne entered the field of optics with the acquisition of Kiernan Optics. This was a company founded by Russ Kiernan in 1950. Russ has some interesting recollections of Singleton and Teledyne. He says,

“my first contact with Henry was in 1963 through a professor at USC where I was teaching in the Graduate School of Business which I was doing concurrently with running my own company, Kiernan Optics.”

“Henry’s interest in my company was because he wanted a precision optical capability while he was striving to obtain the IHAS – Integrated Helicopter Avionics System contract.”

“Our first meeting was brief but it was one in which each of us spoke with complete candor, and that became the basis for our lasting relationship. All our meetings were short but they were very effective. In our first meeting, we had agreed on a mutually satisfactory figure for the acquisition but during the short period in which the deal was being consummated the Teledyne share price declined slightly.”

“I requested a renegotiation but Henry quickly responded you wouldn’t be making that request if the price had gone up. End of discussion. Looking back on that, I thought this is the kind of man I respected and wanted to work for.”

“Either during the acquisition period or shortly thereafter, Henry made a very informal appearance at Kiernan Optics which created an immense impression on our employees. It had been my intention to return to USC to teach full time and write a book but Henry asked me to stay around for a while. That for a while lasted eighteen years as I saw Teledyne grow from a $20 million a year company into over $3 billion annually.”

“During the very early period, 1693 to 1964, Henry sought various methods for raising cash to support company operations. One technique he used was to borrow on the physical inventories of the individual companies.”

Another tidbit shared by Kiernan is that “Henry would sometimes call me and invite me to have lunch with him. We always went to a gardenia poker parlor because the lunches were inexpensive.

I would drive down and pick Henry up at his El Segundo office. These lunches gave us the opportunity to get away from the office environment for discussions about the company or just to chat.

When it was time to pay for our lunches, Henry would always have me pick up the check. I was surprised at first but I was delighted to have the privilege of having lunch with him. I think maybe he was continuing to teach me the value of frugality by not inviting me to an expensive restaurant.” The thread of frugality goes through everything that I’ve read about Singleton and Teledyne, and also about other successful business managers. While some expenses seem trivial that culture of frugality ends up permeating an organization and the results can be enormous.

Kiernan also writes that “as successful as the company became, Henry never felt that luxury automobiles were a necessity at any facility. In fact at one point, Henry suggested that Ford Pintos be used for company cars at all facilities.

This caused a bit of a problem when Jim Stitle and four of his staff, they were all big men in the 6’5”, 250-pound class who worked in the offshore oil industry tried to squeeze into a Pinto. It was an impossible task. The policy was later amended so that large station wagons could be used for field conditions.”

“I remember my final meeting with Henry on February 1st 1981, my day of retirement after eighteen years with Teledyne,” writes Kiernan, “I mentioned my desire to write an instructional book on business-related matters based on my experiences. Henry immediately sat down at his newly-acquired computer. It was the first such device at Teledyne in those days and proceeded to instruct me in the modern methods of writing using a computer.

He spent about half an hour explaining these modern techniques. I was truly amazed that this man who was running a $3 billion corporation will take the time to be interested in my retirement ambitions. I never completed that business policy book but my thoughts of that last meeting still remain with me to this day.”

This is quite interesting because what I’ve also experienced with many leaders is that when you’re in a meeting with them they never seem rushed. They always appear to have all the time in the world. And people who have met Buffett would attest to that as well, even though someone like Buffett obviously could be working frantically all day long.

But for some reason the most successful business managers manage to structure their time in such a way that any meeting that they do have, the person meeting with them feels like they are the most important thing in the world right at that moment and there is no distraction taking place during a meeting.

Roberts writes that “Teledyne made a major breakthrough in January 1965 because of Henry’s original interest in inertial control systems for aircraft. He and his staff had undertaken the development of an advanced airborne computer system that would allow helicopters to take off and land in remote areas without ground navigation aids to flight, in close formation and zero visibility, and to maneuver over difficult terrain without pilot assistance.

Fed data from an inertial platform and radar, it became known as the Integrated Helicopter Avionic System or IHAS competing against some of the largest most well-established companies in the field such as IBM and Texas Instruments, Teledyne was awarded the prime contract for the system by the Navy.

Suddenly, Teledyne had become a major factor to contend with in the aerospace and military systems industry and the company’s stocks soared from fifteen a share to 65 within a year. This gave the company resources to acquire much larger companies than it had been able to before. Sales had reached 86 million in that year with net income of 3.4 million. Company employees had risen from 450 in 1961 to 5,400 by year’s end in 1965. It was an incredible record for a company that was only in its fifth year of existence.

Then in 1966, Teledyne acquired Vasco which is a company that Roberts had been at. It had 43 million in sales and this made Teledyne a fully integrated specialty steel producer with electric arc melting, argon oxygen decarburization refining, vacuum induction melting and vacuum arc re-melting for the production of the highest quality steel products. With these capabilities, metals soon became one of the largest segments of Teledyne’s business.”

What’s striking here is that Teledyne evolved into an industrial conglomerate, many parts of which would be difficult to understand for an investor but Singleton apparently was able to clearly understand the business dynamics of each of these businesses and allocate capital to the ones that would earn him the best return.

Henry Singleton took George Roberts to Houston, Texas shortly after Roberts joined the company. In Houston was Fayez Sarofim, one of Teledyne’s directors who hosted a meeting with financial analysts and Houston businesspeople to meet Henry. Bowman Thomas of Sewart Seacraft, the ship construction company that had been acquired and Dick Bailey of the seismic exploration company were also there.

“Fayez Sarofim had been a classmate of our Director Arthur Rock who had been instrumental in the early financing of the company and had brought Henry and [another individual] together, creating Teledyne’s first major semiconductor operation. Rock was an executive at Hayden, Stone & Company at that time and had introduced Henry to Fayez who ran a very successful business investment service for clients.”

Arthur Rock of course is one of the original venture capitalists and we’ve done a little bit of looking into Fayez Sarofim who apparently has done extremely well in the investment business in a 13F filing with the SEC as of June 2009. Sarofim’s investment management firm had listed an equity portfolio with a value of more than $13 billion. So these are all men of great success that Henry Singleton managed to associate himself with in the early days of Teledyne.

Roberts goes on to say that “Henry spent hours studying the stock and bond markets, and was anxious to have both the funds and opportunity to pursue his life interest. I remember well just after returning from Houston, receiving a letter from Fayez extolling the benefits he could provide us with if I as President would allow him to select our investments.

Since I didn’t yet have any investment authority, I showed the letter to Henry. He quickly told me that he wanted to control the investing of his stockholders’ money. He did so and no one interfered. Not even the heads of the insurance companies who later joined us with their copious millions for investment.

It was not until twenty years later that Henry allowed Fayez to participate directly as a manager of investments from one of our then independent insurance companies. But Henry sought his advice many, many times over those years. Henry did teach me how to study the markets as he did, though only rarely did he ask for my initiative in making selections.

He knew of course that I was aware of the bank of information on corporate stocks and bonds he maintained on his computer system which he had used in evaluating his selections. He frequently discussed the reasons he had for making investment judgments with me so that I would be able to participate and back up his actions, and discuss those actions with our Directors and Executive Team.

He kept his Apple II and Apple III computers busy at his home, building his database, and used those tools incessantly in his management methods. He was a very early pioneer in using personal computers for business, financial, and technical purposes. As most engineers did, he loved the Apple concept and subsequently joined Arthur Rock on Apple’s board.”

So here’s further evidence of Singleton pioneering some methods both in business management as well as in managing Teledyne’s portfolio.

And here’s Henry talking about Russ Kiernan whom we mentioned earlier, when Roberts asked Henry what is so unique about Russ Kiernan, Singleton says that “what’s unique about him is that I’ll ask him a question about one of these companies that I’ve asked him to supervise and he always knows the exact numerical answer. If I ask him what they did in sales last month, he knows right away without calling someone to find out.”

So Henry said “that’s kind of fellow that you pick, who runs a company and does it well but is also able to quickly understand and supervise, and have the facts about other companies under his wind. That’s the kind of a group leader we need.”

Let’s talk about the second phase of acquisitions by Teledyne from 1966 to 1970. In the first six years of operation from 1961 to 1966 sales had gone from 4.5 million to 257 million, net income rose from 58,000 to 12 million and shareholder equity had risen from 2.5 million to 90 million. The company had started with 450 employees and five years later it had nearly fourteen thousand employees.

Roberts writes that he and Henry had always hoped that the owners of managers of the companies they acquired would stay on and continue to manage their operations, and most did.

“Many of these men had started their companies twenty or thirty years earlier with family money and had managed them into the successful and viable businesses that had attracted our attention and some were ready to retire.

In those cases, we often asked if there was a son or other relative who knew the business and would take over and manage it. Sometimes, one of the other top executives or technical people accepted the job. These men knew more about their specific businesses than we did and we wanted to keep their expertise. We had no intention of managing these businesses from the corporate level.

We did, however, establish our own unique financial and operations reporting system under the direction of George Forinsky, which enabled us to monitor their performance closely on a monthly basis and see any trouble spots before they became serious.”

Now, Buffett has said that he gets monthly reports from his subsidiary companies as well and perhaps one learned from the other. But it seems that both Buffett and Singleton wanted to have very timely data from the subsidiaries so they could evaluate their operations, and progress, and profitability, without necessarily speaking with those business managers every month, or even every quarter, or year.

Here are some standards that Teledyne had for deciding whether or not a company was a good acquisition candidate. Here are the questions that Teledyne asked – is the company profitable? Do they have a good balance sheet? Is their profit and loss statement accurate? Do they have a clean inventory? Is their backlog realistic and well-documented? Is their management on top of their operations? Would management be willing to stay if acquired? Have they made long range plans to maximize their profit in a sellout?

Does the business have growth potential? Is their opportunity for growth and profit? Can cash be taken from the company for use elsewhere? How is depreciation counted and is it a significant percentage of profits? What is the condition of their physical plant? And finally, and probably most important, would this company be a good fit within Teledyne organization and its goals?

This is a list of acquisition criteria that should be on every CEOs mind. Obviously, not all of those criteria had to be met 100% but those were the things that Singleton looked at and considered when doing deals. Perhaps one of the things that’s not on the list but was of immense importance to Singleton was the price that was being asked by the seller and also the currency that Singleton could use when making the acquisition.

Singleton also used creative M&A consideration at times, not just cash or stock, when they were acquiring Continental and needed to acquire more shares. Roberts says that “with Continental shares priced at $18 on the New York Stock Exchange in 1969, we offered $1.30 principal amount, 7% subordinated debenture due in 1999 for each share of Continental’s common stock. These debentures paid $2.10 annually yielding better than 12% to those tendering their stock – an attractive deal.”

So just to recap, here we have Continental shares trading at $18, Singleton apparently unwilling to offer a big premium with either cash or Teledyne shares but willing to give $30 in principal amount on a thirty-year fixed rate bond that had a 7% coupon, so in effect at 12% yield that was fixed for thirty years. And obviously, that seemed much better consideration to Singleton than either stock or cash.

Now, let’s look at an acquisition that George Roberts talks about in 1967. He writes “in April of 1967, Henry and I had become quite interested in a new company in Fort Collins, Colorado called Aqua-Tech. These people had developed a very successful product that you will probably recognize called the Waterpik.

It introduced the original idea of using a pulsed jet of water as an oral hygiene adjunct to the toothbrush. It was very efficient at removing food particles from between the teeth that a toothbrush often could not remove.

It was called to our attention and highly recommended by a broker in New York who knew Henry and there was quite a bit competition for the acquisition at that time. We prevailed however and acquired it for a 120,000 shares of Teledyne common stock and up to 35,000 additional shares dependent upon certain contingencies. The acquisition had a market value of over $23 million.”

I find this quite interesting. As another great capital allocator Warren Buffett has said that he’s not interested in buying companies at auction or companies that have a lot of competition for them. It seems that Singleton, while he obviously preferred to make acquisitions with no other buyers there, he didn’t shy away from competitive situations as long as he could use a currency that he thought gave him an advantage. And in this case, it was Teledyne stock.

By 1969, writes Roberts, “Henry and I decided that the prices for other companies we might be interested in were getting too high. This was partly due to increasing competition for these companies by conglomerates such as TRW and others who were growing the way we were. Also, after more than a decade of acquisitions by conglomerates including ourselves, many of the better companies had already been acquired from those available. And there were fewer companies that were really attractive to us.”

So this is when Teledyne essentially ended its first program of acquisitions in 1969. And once that program was ended then there was no longer a need for some of the finders as they called them whose main activity had been finding and negotiating the buyout of suitable new companies. And this is when several key execs left the company as they were no longer needed.

Now, let’s talk about Teledyne’s diversification into insurance and finance. And Roberts calls this Singleton’s second grade purpose. He writes, “Henry talked to me on several occasions about a book by the former Chairman of General Motors Corporation [GM]. He told me he had learned a very important concept form that book which he wished to use in the growth of Teledyne.

He explained that in about 1921 or 1922 after World War I and during a very difficult economic time of recession, General Motors had needed additional funds to finance their growth and had a plan to sell bonds to the general public. The bond sale was a complete failure and the Chairman had written in his book that it had taught him an important lesson.

It was that for a corporation to grow and to have a strong financial base, it needed to have as a part of itself an interest in substantial financially-oriented institutions. So General Motors had started the General Motors Acceptance Corporation and invested in other financial groups.

As a result of his interest in this idea, Henry had decided that at some point when Teledyne had reached a certain size, he would seek out financial organizations we could acquire. So near the very end of our acquisition period, we did go in that direction before we finally stopped.

We began acquiring a number of financial and insurance companies which was a significant change from our usual aerospace metals, industrial and consumer company acquisitions.

The first of these financial institutions was an insurance company in the life insurance business in Chicago. It was the United Insurance Corporation which worked under a holding company called the Unicoa Corporation.

In the years 1968 and 1969, we turned to the Northern California area and acquired a personal savings and loan company organized under the California thrift and loan statute called Fireside Thrift. And another insurance company in Menlo Park specializing in worker’s compensation insurance called Argonaut Insurance.

After the majority stock of the Chicago insurance company had been acquired through several tenders, we went to Texas and bought Trinity Universal Insurance Company of Dallas which was in the property and casualty insurance business. So then we had life insurance and casualty insurance operations of substantial size and a thrift and loan company.

Henry was once asked why the insurance business and he responded that if a company is going to keep on growing at the rate we want to grow, it has to do some new things along the way. What we’re doing now is providing the more stable base that will enable us to produce that growth four or five years from now.”

What’s interesting here is that neither Singleton nor Roberts mentioned float as a key reason for going into insurance even though the investment portfolio of those insurance subsidiaries eventually contributed major profits to Teledyne. Obviously, Buffett has talked extensively about float and how it’s helped Berkshire grow value over time.

The other interesting point here might be that this notion that for a company that wants to grow big and keep growing, it needs to have some sort of financial businesses within it. Today, especially sitting here in 2009, might be a very controversial notion as many otherwise find companies over the past few years got into troubles precisely because they had financial arms – just think of General Electric or even GM or Chrysler.

So this notion to some extent at least has been discredited. But probably because many of those finance companies that have been part of larger companies were really mismanaged in the real estate boom of say 2005 to 2007, and it’s hard to imagine that Singleton would have bought many of the financial instruments that brought some of these larger companies to their knees. And certainly the idea of using float has not been discredited in the least.

Roberts goes on to write that “by 1970, as we began our second decade, we had stopped our direct acquisition of companies. We decided there was no point in paying inflated prices for complete ownership of companies when we could buy a substantial interest in them through our insurance companies when the market prices were favorable.

Of course, we wanted profitable companies that were well-managed than businesses that we thought had a good future. Each of our insurance companies had the usual investment committees to manage how their portfolios were invested but in keeping with our system of running financial matters from the corporate office, Henry headed an investment panel that made all the final decisions on these matters.”

In the February 20th 1978 issue of Forbes magazine, Henry was quoted about his philosophy in regard to this. “There are tremendous values in the stock market but in buying stocks not entire companies. Buying companies tends to raise the purchase price too high. Don’t be misled by the few shares trading at a low multiple of six or seven.

If you try to acquire those companies the multiple is more like twelve or fourteen and their management will say if you don’t pay it, someone else will. And they’re right someone else does.

So it’s no acquisitions for us while they’re overpriced. I won’t pay fifteen times earnings that would mean I’d only be making a return of 6% or 7%. I can do that in T-bills. We don’t have to make any major acquisitions. We have other things we are busy doing.

As for the stocks we pick to invest, and the purpose is to make as good a return as we can, we don’t have any other intentions. We do not view them as future acquisitions. Buying and selling companies is not our bag. Those who don’t believe me are free to do so but they will be as wrong in the future as they have been about other things concerning Teledyne in the past.”

“By the end of 1969,” writes Roberts, “our tenth year in business, sales had passed the billion dollar mark for the first time at 1.3 billion and our net income had reached an all-time high of sixty million. Shareholders’ equity over those years had grown at a compound annual rate of 94%.”

And in a letter to shareholders for the year 1970, Singleton pointed out, “the strong financial condition of Teledyne is evident in our balance sheet. We have an excellent cash position, a ratio of current assets to current liabilities of nearly three to one, and a low funded indebtedness of about 25% of total capital.”

Here’s a point on continued internal growth of the company. “Some outside analysts wondered whether we could keep up the kind of growth and success we had been having without the income from continuing acquisitions. But they hadn’t seen anything yet. In spite of the adverse economic conditions of the 1970s as well as a malpractice insurance problem, and without the contribution of additional income from new acquisitions, Teledyne achieved continuous and rapid growth in sales and income throughout the difficult decade of the 1970s.

From 1971 to 1981, our compound annual growth rate in sales was 11.4% and in net income it was 22.1%. Some of this in the first year of that decade was due to the results of our new financial sector companies.” So that once again speaks to the importance of those financial companies once Teledyne had matured as a company and it wanted to continue its growth.

Here’s an interesting tidbit on the Teledyne identity and corporate image. Roberts writes that “when the discussion of how the acquired company should be identified had come up, Berkeley recommended that instead of keeping their original name or one we gave them, they should essentially keep their name and call themselves Teledyne in front of that name so Teledyne would become an integral part of each name and give each company a more direct identity as part of Teledyne. He suggested that we do this by calling them Teledyne so and so.

Henry thought that was a good idea so we eventually had names such as Teledyne Systems, and Teledyne Brown Engineering, and so forth. With the Teledyne name upfront, our company quickly became recognized throughout the business world. These company identification system standards were enforced quite rigorously.

And when an operating company deviated in their printed material or signage which a few did occasionally, we brought them to task on that. Henry was quite interested and involved in this process. He was very concerned about Teledyne’s image.”

This may sound a little bit contrary to what is said about Singleton elsewhere namely that he doesn’t care about what the press thinks of him or analysts thinks of him. But there’s an important distinction to draw here. He did obviously care very much about what his potential customers thought of Teledyne because that had a direct economic impact on the company whereas what Wall Street analysts thought or the press thought did not impact the fundamentals of Teledyne. In fact, the effect it did have was that sometimes the stock got so cheap that Henry could take it in at a bargain price.

Roberts writes about some of Teledyne’s financial controls to some considerable extent. And this is a chapter that by the way I would highly recommend reading in the book Distant Force. Roberts writes, “for a corporation of our size, we ran a rather lean corporate staff confined to the planning, and reporting, and auditing of the individual company results.

We had a Legal Department headed by the Corporate Secretary, a Financial Department headed by the Corporate Treasurer and a controller, a Public Relations Department to communicate with our publics and very few other activities. I think at maximum we had fewer than 150 persons on our corporate staff.

At the corporate level, our basic interest was in seeing that each company remained a financially healthy and profitable organization. Although we did establish a group executive system, we never let our corporate connection to our individual companies be filtered through too many minds and levels of management as many companies do. There was always essentially a one-on-one relationship between corporate and the managers of each operating unit.”

He also writes that “a lot of people have said that Henry and I managed Teledyne by cash flow and we didn’t do a lot of management by cash flow. We developed a measure that we called Teledyne return which was the average of your cash return and your profit. We’d say, you reported a profit of a million dollars but you only had half a million dollars of cash, so you only made $750,000, so tell us about the rest of the profit when you get it.”

I find this quite interesting because many value investors will say that they only look at the cash flows, they want to base their investment decisions on free cash flow primarily or exclusively, and there is a flaw in that in my mind because there was a reason why accrual accounting was developed.

And the idea was that on the income statement, you could show items that were not in that period’s cash flow but would be expected to contribute or detract from cash flow in future periods. And so the idea of accrual accounting is actually quite important.

Perhaps one of the reasons that many value investors prefer to look at the cash flow statement these days is because of the abuses that the income statement has suffered by virtue of management massaging earnings and making accruals that depended on what the Street expected of the company rather than on what made the most sense. But I find it quite interesting that Teledyne took an average of net income and cash flow, and that’s how they managed their companies.

Roberts also writes that “Henry spent most of his time planning the company’s strategy for future moves and directing our investment portfolios. He was interested in the big picture. I was the one who handled the day-to-day details of operating the company but he most certainly got involved when there were major decisions to be made or problems to be solved.

Almost every day I was in town, Henry and I usually discussed any of the problems or opportunities the company was facing. But quite often, Henry simply talked about his philosophy of running a corporation and the various financial strategies that he came up with as he sat in his corner office each day often working at his Apple computer.

He was a brilliant business strategist just as he was a brilliant chess strategist. He held a 2,100 rating, just 100 points short of a master according to Claude Shannon, and he came up with many creative ideas, ideas that were sometimes contrary to the currently accepted methods of managing a large corporation that prevailed in those days.

He always tries to work out the best moves, Shannon said, and maybe he doesn’t like to talk too much because when you are playing a game you don’t tell anyone else what your strategy is.”

On the Teledyne financial reporting system, Roberts writes that “it was a system in which the individual controllers of each company, each profit center reported to the president of his company and to the home office Controllers Department at the end of each calendar month.

Our fiscal month always ended on a Friday and by the following Tuesday morning, these reports from all 160 reporting entities were in our home office, controller’s office. They came in by electronic mail.”

This speaks to the very good reporting system that Teledyne had in place where even as early as the 1970s, here was a company using electronic mail to send financial reports from the company level to the holding company level by Tuesday morning following a Friday, giving obviously senior management a very good view into how the business was doing.

“With these systems in place,” writes Roberts, “we were able to maintain very close financial control of our operations and our capital management. Though we were criticized for this in some business publications, we were very conservative in our expenditures for capital equipment and facilities as well as for research and development. We concentrated on turning the businesses we owned into efficient cash generators.”

This to me brings to mind some of the criticism that Eddie Lampert has been subjected to as Chairman of Sears. And perhaps one can make the argument that with Sears and K-Mart it’s a little bit different but the criticism of Lampert has focused on the fact that he’s supposed to be a retailer, and as a retailer one is expected to make significant capital expenditures into the existing stores to remodel them and so forth, and also to have a plenty of inventory on hand to display in the stores. Lampert has disagreed with this, arguing that he can deploy the cash elsewhere and reap higher returns. Singleton apparently had the same outlook on capital allocation. [Ed. note: In hindsight, the Sears critics appear to have been right, but would higher store capex have made Sears materially more competitive against Amazon? Indisputable, however, is that Lampert’s share repurchases were ill-advised.]

Roberts writes that “there was a certain amount of resistance to some of the company’s controls in some quarters. Many of the acquired companies had been started by local entrepreneurs who had close ties in their communities and there was a certain amount of resentment at now being financially responsible to so-called absentee managers half a continent or more away. These feelings gradually dissipated as new and younger managers were brought up through their organizations.

Some of these companies had also reached a level of maturity before they were acquired in which their managers and staff had become quite comfortable with their current operations, and sales and profits, and lacked the drive to innovate or take risks in expanding their markets, or product mix, or sales. This attitude also dissipated in most cases with our help as time went by.”

Let’s turn to the all-important stock buyback period that was crucial to compounding value per share at a superior rate at Teledyne. Roberts writes that “in the early 1960s, Henry had used Teledyne stock to make a limited number of equity acquisitions in relatively small companies. He was limited in the size of the companies he would acquire by his company’s relatively low stock price at that time.

But by 1965, Teledyne stock had jumped from fifteen to 65 a share in one year largely because of the company’s success in winning the IHAS inertial helicopter guidance system contract against big competitors such as IBM and Texas Instruments. That gave us the ability to use Teledyne stock to acquire more and bigger companies such as I’ve described until there were 130 in all by the end of the decade.

These events were followed by the bear market of the early 1970s and Teledyne stock prices fell along with the rest from about forty a share to less than eight. Henry saw opportunity where most other company had saw none. Teledyne stock that had gone from a P/E ratio of about thirty to seventy in the 1960s suddenly went to a P/E ratio of about nine, or ten, or eleven to one which was about the same or less than that of companies we had been acquiring.”

Let me just correct something here, the P/E ratio fell to a P/E of nine, ten, or eleven. It never fell to one.

“One morning in May of 1972, Henry walked into my office at about 8:30 and said George we’re going to make a bid for our stock at twenty a share. I said are we really going to do that? I was totally amazed as he hadn’t even hinted about that to me before. It was also a surprise to everyone else at Teledyne when they heard about it including Art Rock who was certainly involved in most of our stock activities.

This was an excellent example of how Henry made all investment and stock decisions on his own. He did this every single time. They were all done when our stock was at a low P/E ratio. He believed that our stock was grossly undervalued and it was the first of a series of eight stock buyback offers.”

Roberts interestingly takes the book Good to Great by Jim Collins to task. He writes, “the author Jim Collins considered that Teledyne had never become a great company because its founder had not prepared a successor when he retired and thus the return to shareholders declined abruptly at that point.

He presented a graph titled The Ratio of Teledyne’s Cumulative Stock Returns to the General Market. It showed a steep price in that ratio over the years to a peak of about nine times at the point of Henry’s retirement and then a decline in the following years.

What this graph did not include after Henry’s retirement was the return that shareholders still received from the stock of the financial companies – Unitrin, Argonaut and other entities that had been spun off to them and that continued to provide them with returns that actually far exceed the returns from Teledyne itself. If cumulative return to shareholders is his criterion in that graph, he missed the mark by a wide margin in judging Henry’s company.”

And this is quite an interesting point here. Roberts deftly dismisses the criticism in the book Good to Great. But I imagine that for those only reading that particular book, the chart would very much support Collins’ view that once a towering founder and CEO such as Singleton retires without a good succession plan in place that value can decline rapidly and obviously the chart showed that, but the chart was completely incorrect in this case.

Let’s look quickly at Teledyne’s international marketing. And here is something that was said by Russ Kiernan whom we had mentioned earlier in this program. He said that “as the decade of the 1960s came to a close and in the early years of the 1970s, Henry recognized the advantages of developing international markets for the company’s products and services.

A few companies had already been engaged in foreign markets and had even established limited overseas manufacturing facilities. To meet these growing operations, Teledyne’s international marketing organization was established in the early 1970s with offices in Geneva, Switzerland and Singapore.”

So here was a corporation smaller than many other large U.S. companies that went global as early as the 1970s.

Roberts writes about the start of Teledyne’s third decade – “we had emerged from our second decade in business as one of America’s leading and most successful corporations, and we looked forward optimistically toward the third. In 1980, our consolidated companies achieved 2.9 billion in sales with a net income of 344 million.”

Then Roberts talks about Teledyne’s first spinoff and the interesting tidbit here is he writes that “in keeping with Henry’s philosophy that the shareholders should be given the opportunity to decide whether or not they wanted to be in this kind of a business, we decided to spin these operations off to them under the name American Ecology.

Thus, shareholders could opt to sell their interests in that business without selling their Teledyne shares if they wished. In the first quarter of this year, we distributed one share of American Ecology stock to our shareholders for each seven shares of Teledyne common stock.”

“1986,” writes Roberts, “was a year of significant management realignments in our company. At the annual meeting in April, Henry announced that he was giving up his title of Chief Executive Officer and that I would assume that title in addition to my position of President. He would remain Chairman of the Board.

He told the shareholders that the title change was in recognition of my leadership since I joined the company as President in 1966. He reiterated those comments in the only intra comm that he ever wrote. Henry was 69 at the time of the announcement. He stressed that the realignment would not mark any major change in Teledyne’s management style and told shareholders that he anticipated that we would continue to work together as a team as we had for the previous 20 years. Indeed, we did work closely together for the next ten years.”

Roberts also has a paragraph again on Fayez Sarofim who was the Founder, Chairman, President and Chief Executive Officer of his investment firm Fayez Sarofim & Company in Houston Texas.

“Sarofim was elected to the Teledyne board at that same meeting at which Singleton announced his retirement. Fayez was one of our early investors and a major shareholder, and in later years became an important advisor to Henry in investment matters.”

In 1987, Henry was seventy and Roberts was 68. And Roberts writes, “a number of our key directors and company managers were over 65. The question of successors and in fact the whole question of just what would happen to Teledyne in the coming years was widely surmised.

In an article in the June 16, 1987 issue of Financial World, the possibilities discussed range from spinning off large parts of the company or breaking it up to taking Teledyne private or selling out. Henry’s response was we’re not particularly persuaded by quick temporary gains. We’d rather get something permanent and it takes time. If there’s anybody who wants us to do something real fast that’s going to be astonishing in terms of increased earnings or something, I don’t know how to satisfy such desires.

When pressed about spinoffs being a good way to boost shareholder value when acquisitions are too pricey, he replied, you’re thinking in the short term. I’m in the long term so I wouldn’t do anything like that for a temporary rise in the price of the stock.

You know there are companies that will sell one division and buy another because today this division generally supports a low multiple and the one they’re buying has a high multiple, and they think that may rub off on the whole company. That absolutely turns me off. The whole concept is repulsive. We don’t do things like that. We look at the economic long term possibilities.” Obviously, a strong statement here by Singleton regarding some of the idiocy that he saw in business management at the time, and unfortunately that hasn’t gone away over the decades.

Here’s an interesting perhaps final paragraph from the book, Roberts writes that “a final assignment from Henry Singleton was unfortunately given to me in his home a few weeks before he finally left us. Knowing he had a brain tumor, he had a final concern about our 1986 spinoff of Argonaut Group.

The board of Argonaut in 1989 had agreed with Henry that a study should be made to sell the company to another group or company so that we could be excused for managing the entity. He was disappointed as an investor in the performance of the stock under $20 a share and hoped that we could sell it for at least $30 a share. An outside firm had been hired to help do this job. After a number of months, the effort was canceled by the Board as no buyers were found.

Henry always thought that the management of the company not wishing to be replaced had failed in the marketing effort. He told me on that sad day that if he left us it would be my duty to replace the management and solve his problem.” What this paragraph shows is the unique dedication – you could call it fanatical, perhaps that Singleton kept to Teledyne until the very last days of his life.

Subsequent to Singleton’s retirement and passing, Teledyne was targeted by several hostile acquirers, eventually ended up merging. And today, certain pieces of Teledyne exist as independent companies while others exist as parts of larger companies.

This brings our program about Henry Singleton to an end. This recording and transcript are property of BeyondProxy, the publisher of The Manual of Ideas. I do point out that many of the quotations in the recording are from George Roberts’ book Distant Force which we highly recommend. Thank you.