This article is authored by Soumil Zaveri, MOI Global instructor and capital allocator at DMZ Partners.

Indian banks and financials have always been heavyweights in our family office holdings. Our keen interest toward them is driven by the confluence of a few very favorable factors, which are highlighted in this note, juxtaposed with a little bit of background and storytelling.

Diligent financial management teams and owner-operators have built exceptional long-term track records driven by resilient underwriting standards, cost leadership and customer centricity in an environment where private lenders (as opposed to government promoted and controlled entities) were allowed to start formal banking operations only as recently as 1994 (excluding a few very small, regional “old private sector” banks and non-banking financials companies (NBFCs) which operated with several limitations).

This slack in the public sector banking system combined with a growing middle-class has allowed for performance-oriented private lenders (banks and NBFCs) to reap rich rewards…

In this regard the public sector lenders had more than a four decade-long head-start in post-independent India. Although their combined market shares have consistently eroded they remain the largest financiers in terms of lending (~71%) and deposits (~74%). The majority of them have often been stymied by weak branch-level governance, poor operating performance, sub-optimal underwriting capabilities, insufficient technological infrastructure, poor alignment of interest and a reputation for inadequate customer service. These issues have manifest themselves in their “share of market capitalization” among listed banks and NBFCs, which has consistently declined and now hovers below 30%.

Public sector banks have been able to retain such market shares because their largest equity holder is less demanding of purely financial outcomes. Rather, these banks are viewed as a platform to improve the breadth and depth of banking penetration in the country — especially in less affluent villages where full service branches may not make economic sense purely from a financial perspective. While this approach has been successful in creating an extensive branch network across the country it has come with higher operating expenses and weaker underwriting standards. This has led to the unsurprising outcome that despite their >70% market-share their share of stressed assets stands at 90%. Their weaker balance sheets have hampered their ability to extend credit to grow their loan books and raise meaningful capital.

Despite these institutions’ social responsibility-based approach, India continues to be credit hungry. Household debt, mortgages and consumer financing as a percent of GDP are at fractional levels of not just developed economies but even several developing ones. All this in an environment which is known for a low base level of consumption, high housing shortfall combined with increasing disposable incomes and affordability.

This slack in the public sector banking system combined with a growing middle-class has allowed for performance-oriented private lenders (banks and NBFCs) to reap rich rewards — for example, HDFC Bank (incorporated in 1994 and now the largest private lender in India) has grown earnings at ~37% CAGR from INR 0.2 billion in 1996 to INR 122.96 billion in twenty years. Kotak Mahindra Bank (converted to a bank in 2003 and now the 4th-largest private lender) has grown earnings at ~35% CAGR. Both companies have rewarded investors commensurately over any reasonable timeframe along the way.

Despite several years of continued compounding, even today HDFC Bank’s market share is ~5% (Kotak Mahindra Bank is less than 2%). Given the market share gains that are to be had from the large, less efficient, capital-constrained public sector and the overall growth in the addressable market for consumer and small business lending, we believe businesses like these continue to possess extraordinarily long runways for growth from here on as well.

Nonetheless, one could argue that credit growth for the largest of private banks and NBFCs is likely to remain somewhat tethered to nominal GDP growth plus several percentage points for market share gains. However, smaller, well-capitalized NBFCs have proven to be particularly agile. We expect the low bases they are growing from to be even more conducive to sustained long-term performance.

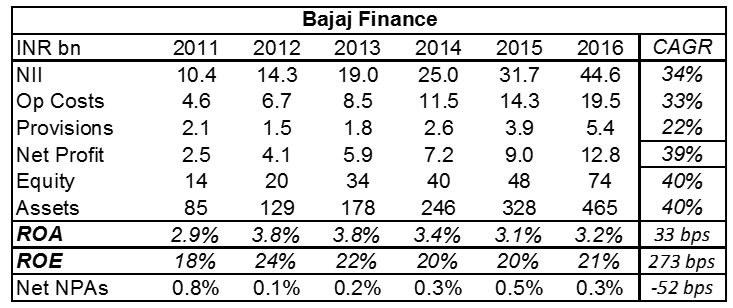

For example, Bajaj Finance (a diversified consumer NBFC which pioneered concepts like no interest EMIs for purchasing electronics) has grown loans almost six-fold in five years; profits have grown at a 39% CAGR, driven by cross-selling within their franchise — 57% of disbursements are repeat clients with more than three products per customer. This is commendable given that acquiring customers is an expensive ordeal. Despite significant disruption (demonetization of 86% of currency), recent results have been solid by almost every parameter. With market share of merely 0.6% we are optimistic about their prospects.

It is hard to disagree that the degree of success of any business is dependent on several external factors. However, we believe perhaps ironically that agile financials have a strong hold on their own financial destinies (barring extreme scenarios which are a small fraction of possible alternative outcomes). Their performance during the recent demonetization has been another testament to their resilience. While we are evidently optimistic over the long haul, studying the best of these businesses has shown us that they have performed robustly despite strong headwinds even in the medium term. We believe that in adversity their recovery periods to normalize and resume growth have gotten progressively shorter as processes have grown more iterative and experiences dealing with distress have improved. As is often the case in our business, the most vexing times have also been the most opportune. This certainty factor plays an important role in our long-term conviction in a handful of these companies.

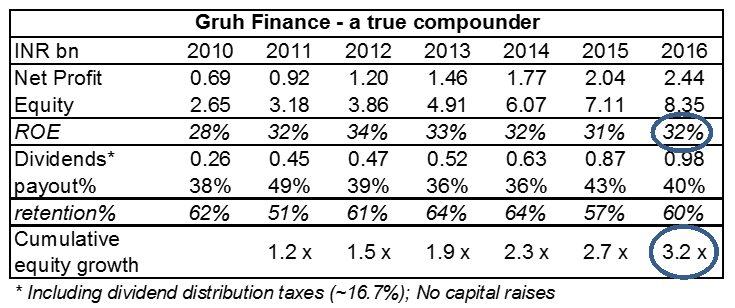

The very nature of financials make the high-quality ones particularly exceptional capital allocators. While good businesses earn juicy returns on capital, great ones have plenty of opportunities to reinvest the incremental capital at equally compelling rates. The great financials, depending on the nature of their businesses, earn ROAs of 2.5-4.0% and ROEs of 17-30%. Given the longevity of the growth runway, they are able to reinvest the bulk of their earnings back into the business at attractive returns. We have usually been advocates of them retaining more and paying out less. For example, Gruh Finance has earned ROEs of 32% and reinvested 60% of earnings in recent years. This has led to a phenomenal result — over six years shareholders’ equity has more than tripled and the company continues to earn the same high returns on equity on this much higher base — a true compounder! We would much rather they retain 15-20 percentage points more and earn 32% on it rather than paying it back to us.

Gruh has a wide moat in form of the domain expertise associated with lending to lower-income families for purchasing affordable homes without conventional documentation proof (milkmen, vendors and painters usually don’t file taxes). Deep understanding of cash flows associated with such professions is key to underwriting sensibly and managing credit costs. In a low ticket-size and granular business, operational and collection costs can take a real toll. Despite this Gruh exhibits deep operational frugality.

Gruh’s leverage is typically higher as the product is a first-and-only secured mortgage for an owner-occupied home. Typically a ~US$11,000 loan is used to finance the purchase of a ~US$20,000 home. The low credit costs (Gross NPAs ~60 bps fully provisioned) due to disciplined underwriting, efficient collections and industry-leading cost control allow Gruh to earn a higher ROA while competitors deal with prohibitively high operational and credit costs.

Mr. Market has usually appreciated the qualities of such businesses once performance is evident. This has allowed select financials to raise incremental growth capital if required on exceptional terms — at many multiples of book value! Time has shown that due to the sustained high-quality performance of such financials even subscribers at higher multiples have often gotten a great deal in hindsight.

The underlying source for high ROEs is different for each financial — given its product mix, Bajaj Finance earns a higher ROA of >3% (derivation below).

Bajaj Finance reinvests >85% earnings at rates >20%. Reiterating this result for decades has been the source code for all great financial compounders.

Of course, not every bank or financial is an emerging HDFC Bank or Bajaj Finance. For every potential compounder there are several certain capital destroyers. We have usually steered clear of segments like gold loans, microfinance, infrastructure, construction equipment, and commercial vehicles — from what we have learned some of these businesses are far more difficult to differentiate on and build superior operating cost structures or witness credit costs meaningfully lower than peers; others are more prone to excessive regulatory oversight or poor consumer credit discipline. Some of these segments have become more commoditized with more credit supply chasing stalling demand. Managements which have exited such segments have sometimes commented, “That was a mediocre business in good times and a terrible one in tough times.” We highlight a snapshot of one such business (name withheld — our intention is neither to malign nor embarrass — these are usually good people in tough circumstances).

At Financial “A”, credit costs escalated due to distress in their core markets, customers became delinquent very fast — provisions ate into profitability. ROAs and ROEs compressed significantly. Management has struggled to create any real differentiators which can trickle down to the numbers that matter. These businesses have depended on blue sky scenarios to do well and tougher times have been largely unforgiving to their profitability. The opportunity costs for investors in such businesses have often been very high.

…’edge’ may meaningfully affect the ability of a financial to lend competitively yet experience below-peer credit costs, or grow efficiently yet have lower operational costs than competitors, or earn better yields on product innovations that competitors find painful to replicate.

In searching for opportunities we look for the basic ingredients of a successful compounding recipe. Ultimately we are trying to ascertain the source of competitive advantage in each vertical and for the cumulative franchise. Such edge may emanate from several sources and will eventually show up in the numbers. For example, edge may meaningfully affect the ability of a financial to lend competitively yet experience below-peer credit costs (lower NPAs and provisions), or grow efficiently (strong loan growth) yet have lower operational costs (declining cost to income) than competitors, or earn better yields (higher net interest margins) on product innovations that competitors find painful to replicate (higher upfront costs and NPAs). It’s usually not real edge unless it has a meaningful impact on ROA. While these are quantitative measures they have their underpinnings in management’s decision making. Invariably, the largest contributor to the business’ future value boils down to a qualitative measure — management quality. It may be absolutely crucial for businesses yet developing moats and less so for deeply entrenched businesses.

Typically we want to own financials in businesses that we are able to understand but competitors find difficult to execute. The prevailing rates on assets and liabilities are largely market determined — hence an NBFC’s ability to operate efficiently, acquire customers inexpensively, streamline distribution, underwrite rationally, keep credit costs low, are all sources of advantage. Clearly certain product lines are better suited to long-term success than others — we’ve preferred businesses focusing on retail segments — housing, small business, personal, consumer loans for durables, electronics & lifestyle products — these are more granular businesses which make them adaptable to differentiate on technology, product innovation and many small operational improvements over competitors — also they are largely under-penetrated segments country wide. Dozens of such “mini-moats” add several basis points to operating results. A great example of the cumulative effect of doing things that are simple but not necessarily easy.

The banks and financials we have owned over time have been incredibly forgiving in one more aspect. We are notoriously poor market timers (not that we make any attempt). We often mock ourselves at how we’ve often bought stocks when prices were at 52-week highs. This has led to the origin of a new phrase in our discussions — “Own companies which allow you the privilege of buying high and selling low!” Though we are rarely sellers of great companies we want to own businesses which allow you to buy at 52-week highs and sell at 52-week lows and still earn a great return — given that the magic of compounding is allowed to work for several years in the interim.

At Asian Investing Summit 2017, Soumil shared the optimal “setup” he seeks while scouting for Indian financials that have the potential to emerge as great long-term compounders for patient allocators. Soumil also shared such an idea at the conference.

Sources: Capitaline Plus, HDFC Bank Annual Reports; Kotak Mahindra Bank Annual Reports; Bajaj Finance Annual Reports; Gruh Finance Annual Reports; Bajaj Finance Investor Presentations; Kotak Mahindra Bank Investor Presentations; Report on Trend and Progress of Banking in India (Reserve Bank of India); Reserve Bank of India Database; DMZ Partners estimates.

Disclosures: Positions held by DMZ Partners or associates may be inconsistent with views mentioned herein. DMZ Partners or its associates accept no liability for any errors or omissions in the given content. The material presented herein does not constitute a recommendation or offer for the purchase or sale of any securities and is provided solely for informational purposes. DMZ Partners offers no investment related products or services whatsoever. Please consult a certified financial advisor before making investment decisions. Unauthorized usage, alteration or distribution of this information is prohibited.

About The Author: Soumil Zaveri

Soumil Zaveri moved to the US in 2005 to study Economics and Biology at Duke University, in North Carolina. He had the good fortune of being taught by phenomenal professors including Dr. Emma Rasiel. At Duke he presided over the Investment Club with, now good friend, James Schulhof. In the summer of junior year, He interned with Goldman, Sachs & Co. in New York on the healthcare team with in the Research division. He was extended a full time offer and joined the banking team there after graduation. He witnessed an exponential learning curve while working with Richard Ramsden, Brian Foran, Quan Mai & Ryan Fulmer through the financial crisis. Given the magnitude of changes affecting the western economies, the resilience of Asian ones and his desire to be back home, after a few years in New York, he moved back to Mumbai to start his own investment firm, and to work directly on allocating personal and family capital.

DMZ Partners was founded on 1st April 2011 as a partnership firm. His grandfather, who was very fond of him, was Dinesh Mahsukhlal Zaveri (initials DMZ), and co-incidentally his father’s great grandfather who was a successful businessman of his time, Dahyalal Makanjee Zaveri also carried the same initials.

More posts by Soumil Zaveri