This article is authored by MOI Global instructor Santiago Domingo Cebrián, portfolio manager at Solventis SGIIC, based in Barcelona.

Jack Welch, former CEO of the American company General Electric, stated the following words in one of his famous speeches: “The three most important things you need to measure in business are customer satisfaction, employee satisfaction and cash flow”.

This sentence fits seamlessly with the philosophy that the French company Akka Technologies has kept since its inception in 1984. First of all, the satisfaction of Akka’s customers is observed in that almost 95% of them repeat projects with the company, given that the interest is reciprocal because the client spends time and money in Akka and vice versa. Secondly, employee satisfaction is noted in its low employee turnover rate close to 17% compared to 25% of some of its competitors. In addition, Akka gets the most innovative projects, which serve as an incentive for young talents not only to begin their professional career with Akka, but to stay there for a long time. Thirdly, the cash flow has doubled in the last five years, showing the company’s enormous capacity to reinvest profits.

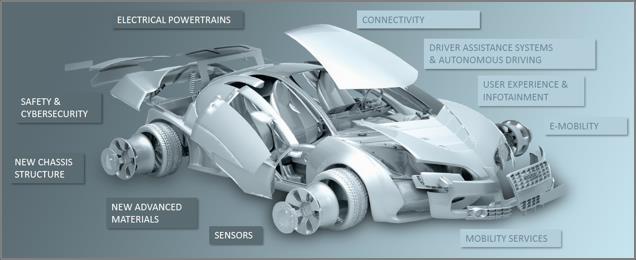

The three principles above-mentioned are a good starting point for any company, but what Akka does? This family business provides technology and engineering consulting services to carmakers, airplane manufactures, among others. For example, if Volkswagen wants to develop a project about the autonomous car or Airbus wants to design a new aircraft aerostructure, they contact Akka to help them in those projects, since Akka has the most specialized and experienced human capital. The knowledge of Akka engineers covers all the car technologies as you can see below.

Source: Akka Technologies

Source: Akka Technologies

But before beginning with the company valuation, let us talk about the technology consulting sector, in which Akka operates.

This sector has the huge barrier of entry that implies being present in the list of certified suppliers of Daimler, Renault, Boeing, etc. In order to be eligible for projects from large manufacturers, you need to have a considerable size and execution capacity. This fact hinders the entry of new competitors in those lists, leaving ample room for the three biggest players in the sector: Altran, Alten and Akka.

Also, it is a sector with a sustained, renovator and resilient growth. Sustained growth because it does not depend on a single technology or trend but covers all of them and its growth is the growth of innovation, which progresses at around 12% per year. Renovator growth because the new technologies set aside the old ones, making the processes more efficient and productive. Resilient growth because even during the last financial crisis, carmakers barely reduced their spending on research and development, as you can see below.

Moreover, it is a very fragmented sector, given that there are many small and inefficient companies. Therefore, the big players are keen on making acquisitions to reach the greater size the better. However, it is not a good choice to buy at any price, no matter how much you are interested in growing. In this matter, Akka also beats its competitors, as it prefers to make bolt-on acquisitions instead of big acquisitions. In addition, Akka buys cheaper than the rest of the players, as shows its lower goodwill to sales ratio.

Source: Company Statements

Source: Company Statements

Once we have understood the sector in which Akka does business, we will move on to the figures. After successfully finalizing its latest strategic plan, Akka disclosed a new plan with targets for the year 2022. Its main objectives are: to double sales to reach 2.500 million euros, achieve an EBIT margin of 10% compared to current 7% and achieve a free cash flow of 150 million euros.

We are going to challenge these projections, because we want to check if they are really viable or not. On the sales side, that growth is based as much on buying other companies as on doing it organically. The organic growth is gonna be achieved by increasing sales to current customers and focusing on high added value technologies such as autonomous cars, artificial intelligence, and so on so forth. The margin improvement is plausible, since Akka has some projects in ramp-up, has a utilization rate below the average and its competitors already get that 10% margin, therefore Akka has triggers to get it too. If sales and margin targets are met, it will be relatively easy to achieve a free cash flow of 150 million euros.

After verifying that the plan is feasible, that Akka has an enviable position in a growing sector with high barriers of entry, with little debt in its balance sheet and with the ability to reinvest profits, the company valuation is relatively simple. We take the aforementioned 150 million euros of free cash flow, from which we subtract 10 million due to the integration costs of the acquired companies, given that this cost is recurrent in a sector with so many acquisitions. To those 140 million resulting we apply a multiple of 15x in line with the average of the sector, which gives us a company value of 2.100 million euros that compared to a market cap of 1.260 million euros, results in a margin of safety above 65%.

Note: this report is not a recommendation neither for acquisition nor sale. The here cited comments reflect personal opinions of the author.

About The Author: Santiago Domingo Cebrian

Santiago Domingo es gestor de renta variable en Solventis. Codirige el fondo de renta variable europea Solventis Eos desde 2017. Es graduado en finanzas y contabilidad por la Universidad de Zaragoza. También posee el título de máster en instituciones y mercados financieros por CUNEF.

More posts by Santiago Domingo Cebrian