Herd mentality is everywhere.

We know it well in investing. The exuberance or fear of fellow market participants is contagious, and only the most independent-minded investors are able to resist the pull of the herd. The latter is so strong that clear-thinking investors are often called “contrarian” even though they are simply unaffected by the crowd.

Herd mentality prevails not only when it comes to investment decisions but also investment business decisions — how a manager structures fees, treats clients, exploits loopholes in the law and, yes, cheats. High-frequency trading, market manipulation, spreading of false rumors, trading on inside information are examples. In some market environments there are more cheaters than in others, not because the participants have changed, but because the herd has come to consider a questionable practice to be “how things are done these days”. Those who refuse to go along have to accept the possibility of being left behind.

The urge to follow the herd is perhaps strongest in the world of sports, particularly in disciplines in which pure speed or endurance determines success. In those sports, luck plays a smaller role than in multi-factor, low sample-size (i.e., low-scoring) sports such as soccer.

In cycling’s era of Lance Armstrong many otherwise honest athletes were sucked into cheating because doping was the open secret — it was illegal but perhaps perceived as not entirely wrong because seemingly everyone was doing it. It’s not hard to imagine the predicament of a competitive, goal-oriented cyclist of Armstrong’s generation. Without doping, he did not have a fair shot at beating Armstrong and the other dopers. In the athlete’s mind, he had to choose “unfair” over “illegal”. That’s a tough choice.

One athlete made the choice to put himself at a disadvantage. He stayed clean in a sport in which pure speed is everything:

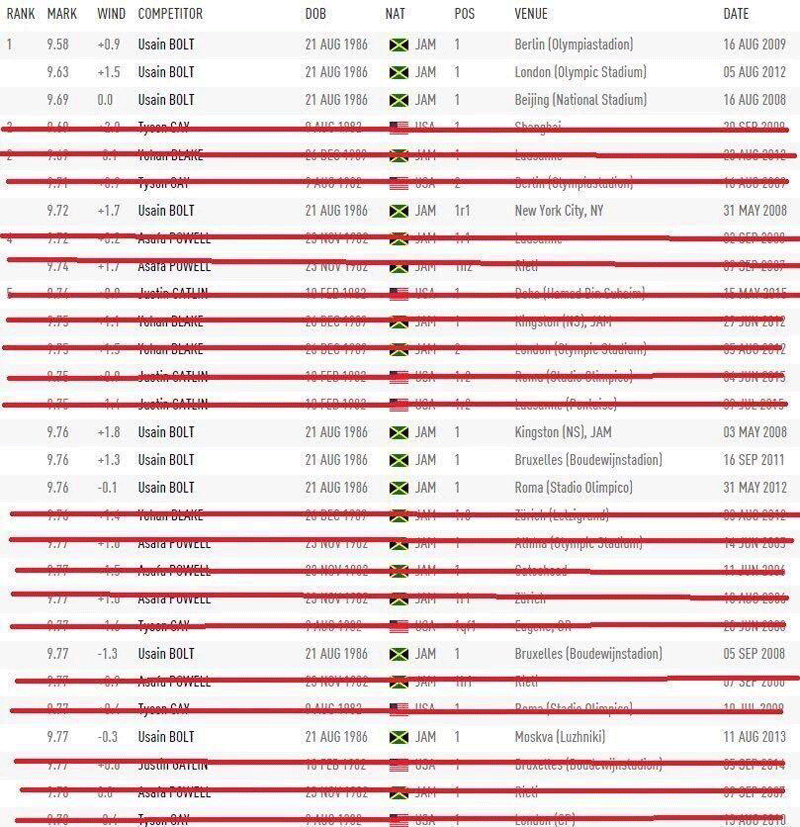

Bolt’s success is impressive for its sheer record-breaking nature. It’s even more impressive for the way in which Bolt achieved it. The above table shows the fastest 100-meter sprints of all time, with the names of dopers crossed out. The other names are all “Usain BOLT”.

Investing is not about raw brainpower. It is not about who crunches more numbers, talks to more people, or gets more “scoops”. It is to a large degree about judgment, a long-term orientation and, yes, luck.

In such a field, resisting the pull of the herd should be considerably easier than it was for Bolt. We need to stop being afraid to look silly.

Prepare to be wrong and alone occasionally. The rewards are long-term outperformance and, perhaps more importantly, the knowledge that you stayed true to your convictions.

About The Author: John Mihaljevic

John serves as chairman of MOI Global, the research-driven membership organization. He is a managing editor of The Manual of Ideas, the acclaimed member publication of MOI Global. Previously, John served as managing partner of private investment firm Mihaljevic Capital Management. He is a winner of the best investment idea prize awarded by Value Investors Club. John is a trained capital allocator, having studied under Yale University Chief Investment Officer David Swensen and served as Research Assistant to Nobel Laureate James Tobin. John holds a BA in Economics, summa cum laude, from Yale and is a CFA charterholder.

More posts by John Mihaljevic