This article is authored by MOI Global instructor Pieter Hundersmarck, global portfolio manager at Flagship Asset Management, based in Cape Town.

The term “investment boutique” is used to describe a relatively wide range of asset management firms. However, the general consensus is that investment boutiques are smaller, independently-operated firms where management own at least 50 percent of the equity, the investment services and products are deeply specialized and personalized, and where the AUM is less than $2 billion.

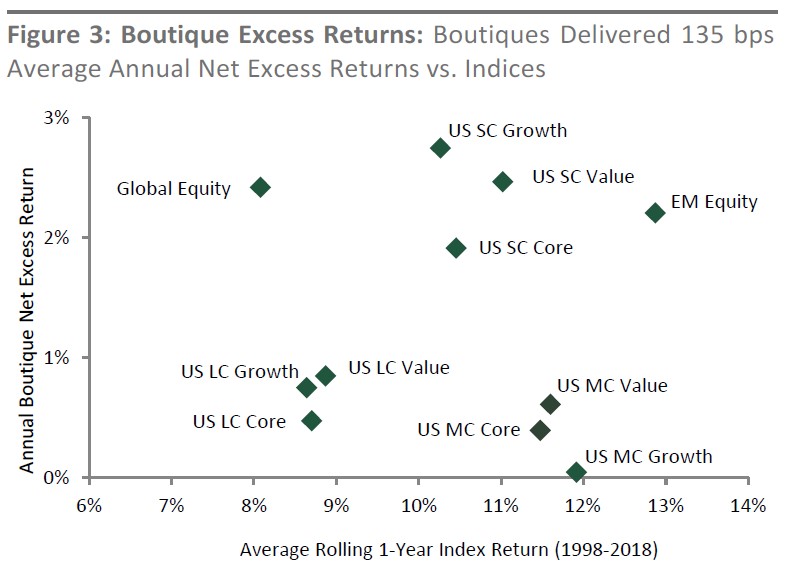

A study conducted by US-based Affiliated Managers Group (AMG) in 2018 found that, “Boutique active investment managers have outperformed both non-boutique peers and indices over the last 20 years.”

The charts below illustrate this. Figure 1 shows the average annual outperformance of boutiques vs non-boutiques while Figure 3 shows the average rolling returns of boutiques versus indices, both over twenty years (1998-2018).

The study also mapped out a number of “core characteristics” that position boutiques to add value for clients. I discuss them below in relation to how we at Flagship have structured our boutique.

Alignment of interests

Direct equity ownership ensures that key principals have a vested interest in the long-term success of a boutique.

Many of the most talented investment professionals in the world are drawn to the boutique structure, where the incentive system allows them to own the results of their investment performance.

It is also often the case that these investment professionals have a significant portion of their personal net worth invested in the portfolios they manage, creating a long-term mindset and commitment to stated goals.

At Flagship, 65% of the business is owned by fund managers in addition to their remuneration being tightly aligned to fund performance. We think like owners and act like owners. We also apply this line of thought to the companies in which we choose to invest, assessing them from a holistic perspective as opposed to that of a minority shareholder. This creates a skin-in-the-game mentality that adds a deeper dimension to investment decisions and improves investment outcomes.

Multi-generational management

The presence of a multi-generational management team, including a succession plan, is another core foundation of a boutique. This ensures that key principals will continue to remain motivated and highly involved in business development.

Many boutique asset management firms owe their unique philosophy to their founding members. What begins as a successful investment strategy for the founders of the firm develops into a time-tested, original and robust investment approach that is lived and breathed by the fund managers.

While some boutiques may still be owned and operated by the founders of the firm, many enjoy multi-generational investment managers who honour the founder’s original legacy. This results in both a strong investment and company culture, creating one of the uniquely successful propositions of boutiques.

Culture starts with what people do and how they do it. In asset management, what people do may not differ dramatically, but high-performing investment firms distinguish themselves in how they do it. This cumulative effect of what is done and how it is done ultimately determines a firm’s performance.

Flagship Asset Management is a privately owned, independent, global specialist boutique asset manager, founded in 2001 by Simon Hudson and Winston Floquet. Our global portfolio managers have an average of over fifteen years investment experience on average. This ensures not only a long-term mindset, but an enduring investment culture which results in consistent execution of our investment strategies over time. It is for this reason that Flagship is one of South Africa’s most awarded boutique asset managers.

Entrepreneurial culture with partnership orientation

Key partners control the daily operations of a boutique and are actively involved in business planning and building an enduring franchise.

Talented investors are more likely to be drawn to boutiques that offer an entrepreneurial culture and allow them to have a direct impact on the future success of their business.

Hugely beneficial to clients is the level of accessibility and interaction that is afforded by the fund managers of a boutique investment firm. Due to the smaller staff compliment, boutiques seldom invest in large sales teams, preferring to explain their unique investment philosophy and approach themselves. As owners of the business with vested interests, client interaction takes place on a commensurate level.

At Flagship, we have been growing, preserving and protecting our clients’ investments since 2001. Our clients are our partners, and we spend time communicating our investment decisions to them. As co-investors in all Flagship funds, we treat our clients as we would like to be treated – professionally, timeously and candidly.

Investment-centric

A boutique has an investment-centric organizational alignment, typically geared to a distinct investment philosophy with a highly focused investment process.

Investment-centric considerations have primacy at a boutique, and are more likely to lead to optimal risk-adjusted returns. Boutiques typically have flat organizational structures with fewer management layers and significantly wider spans of management control. Back-office functions are often outsourced, thereby keeping the routine chores of running a business to a minimum, in order to maintain a primary focus on investment management. The benefits of a simple structure are increased organizational agility and reduced micromanagement.

Founders of boutique asset managers have little desire to build empires. They, and the fund managers they attract, are driven by a passion for investing. Boutique investment managers are nimbler than their larger counterparts and able to quickly take advantage of opportunities due to the lack of bureaucracy.

At Flagship Asset Management we benefit from a simple, horizontal organisational structure. Our size and office plan create an inclusive culture where every team member carries full accountability for their role. Each person’s contribution is heard and valued.

As a small team, we use our time wisely. All non-investment functions including bookkeeping, accounting, trading, fund pricing and administration are outsourced. Portfolio managers spend 90% of their time making the investment and asset allocation decisions necessary to run global multi-asset and equity-only funds.

Commitment to building an enduring franchise

Key principals are committed to the long-term growth and success of a boutique, often signalled by their willingness to sign multi-year employment agreements.

A stable, long-term environment is ideal for generating investment success, and a group of principals bound together by long-term equity is well positioned to deliver this success.

It is inevitable that larger investment firms experience greater staff turnover and require long term incentives to retain key personnel. Boutiques tend to think of themselves as a family, where the quality of the work environment and the ability to directly impact results is of greater importance. This leads to high levels of collaboration, collective effort and ownership. Management tenure, which is critical for the success of actively managed funds, together with low staff turnover, result in a strong investment management culture which leads to consistency over time.

At Flagship, our global portfolio managers have an average of over fifteen years investment experience on average and there has been no investment management or operational staff turnover in the last ten years. We believe this leads to an enduring investment culture, resulting in the consistent execution of our investment strategies.

Focused, active asset management

Focused active managers outperformed generalist managers as well as their benchmarks after fees. Even in the most efficient markets, focused active managers added more on the upside and lost less on the downside.

In focused asset management firms, everyone in the firm is devoted to ensuring that their single strategy is successful. There are no conflicting priorities, no new product initiatives, no resource allocation discussions and no new launch roadshows. The firms’ clients know that every single person on the organisation chart is solely devoted to the strategy they are invested in – and nothing else.

At Flagship, our investment philosophy is long-term focused, fundamental, and exploits a limited universe of quality companies that exhibit attractive growth and quality characteristics. Our process is rigorous, and its application is intrinsically linked to the concentrated manner in which we build portfolios of maximum 25 stocks. Our process focuses on downside protection, leading to better outcomes at market dislocations such as the GFC in 2009 and most recently during the Global Pandemic of 2020.

Adhering to core characteristics enables boutiques to add value to their clients

Flagship’s unique proposition is built on three pillars:

- Specialization: Success in any endeavour comes from focus. We are focused on a small number of strategies where we have the skill and experience to add value.

- Global experience: Our global portfolio management team is highly experienced across global asset classes.

- Independence and alignment: We are owner-managed, and pride ourselves on being able to apply an independent, global perspective to our portfolios.

As we enter the uncertain post-pandemic world, we believe these pillars allow us to offer something unique an valuable to our clients.

Members, log in below to access the restricted content.

Not a member?

Thank you for your interest. Please note that MOI Global is closed to new members at this time. If you would like to join the waiting list, complete the following form:

About The Author: Pieter Hundersmarck

Pieter Hundersmarck is the Chief Investment Officer of Castra, a family office based in Amsterdam. Pieter has been investing internationally for over 15 years and has broad experience across asset classes in developed and emerging markets. Prior to Castra, Pieter worked at Flagship Asset Management, one of South Africa’s most awarded boutique asset managers. Prior to that he worked at Coronation Fund Managers for 10 years, and also co-managed a global equities boutique at Old Mutual Investment Group. Pieter holds a BCom (Economics) from Stellenbosch University and an MSc Finance from Nyenrode Universiteit in the Netherlands.

More posts by Pieter Hundersmarck