This article is authored by MOI Global instructor Stuart Mitchell, investment manager at S. W. Mitchell Capital, based in London.

Stuart is an instructor at European Investing Summit 2024.

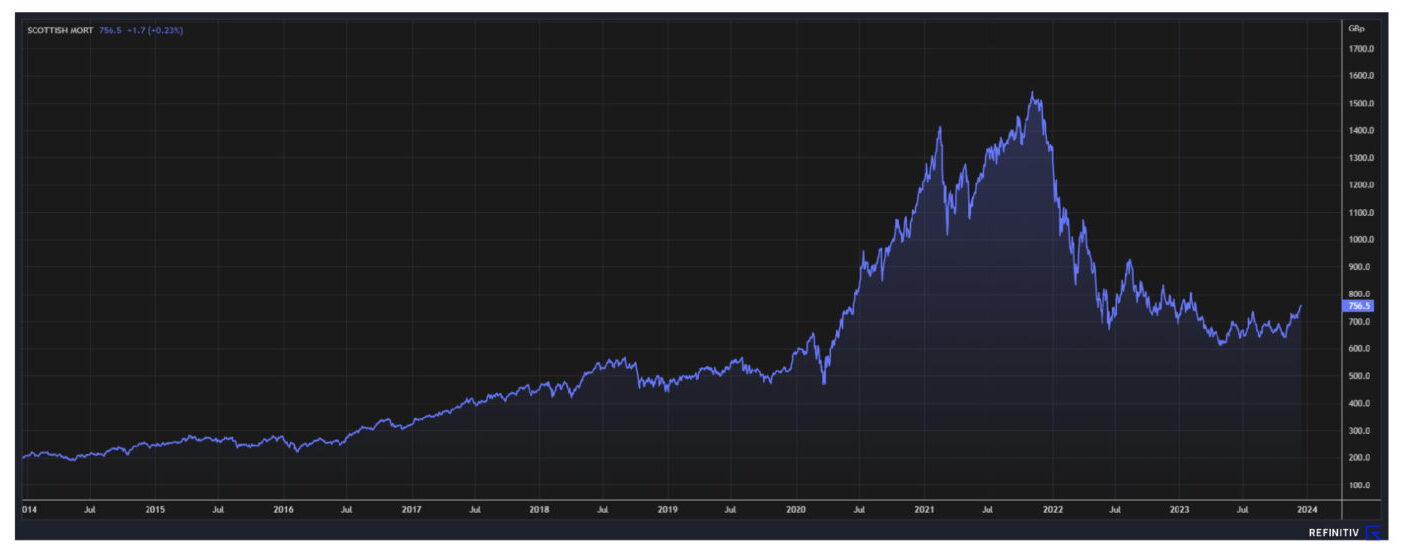

Over the last ten years markets have been characterised by unusually low interest rates and all sorts of resulting distortions in capital markets. In the equity world, the dash to speculative technology and growth-at-any-price has led to an extraordinary boom and bust of fund managers like Cathie Wood and Baillie Gifford.

The Scottish Mortgage Trust share price

Source: Refinitiv

But even now, seventeen months into a tightening cycle, investors continue to be lured into new bubbles dreaming that they have found another Nvidia.

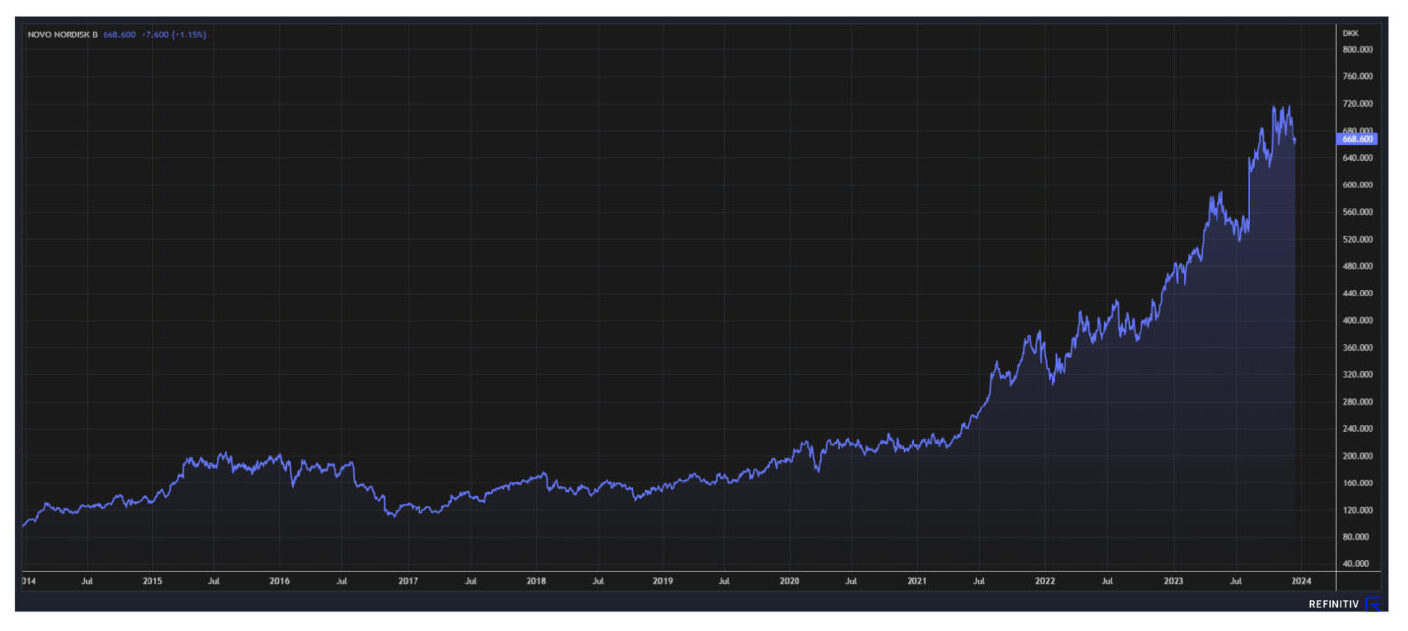

One such bubble may well be Novo Nordisk. The share price has risen by almost three times over the past two years driven by expectations for their anti-obesity drug Wegovy.

Novo Nordisk share price

Source: Refinitiv

So what is Wegovy? Wegovy is the weight loss brand name for Semaglutide that was originally developed by Novo to treat type 2 diabetes in 2012.

Wegovy is a glucogen-like peptide-1 receptor agonist (GLP-1) that mimics the incretin glucagen-like peptide-1 to increase the production of insulin and lower blood sugar levels. The effect is to lower appetite and slow down the process of digestion in the stomach. The STEP1 trial published in 2022, ‘revealed an average 14.9% reduction in bodyweight from baseline during 68 weeks of treatment with semaglutide 2.4 mg plus a lifestyle intervention, compared with just a 2.4% reduction in the placebo plus lifestyle intervention group.’

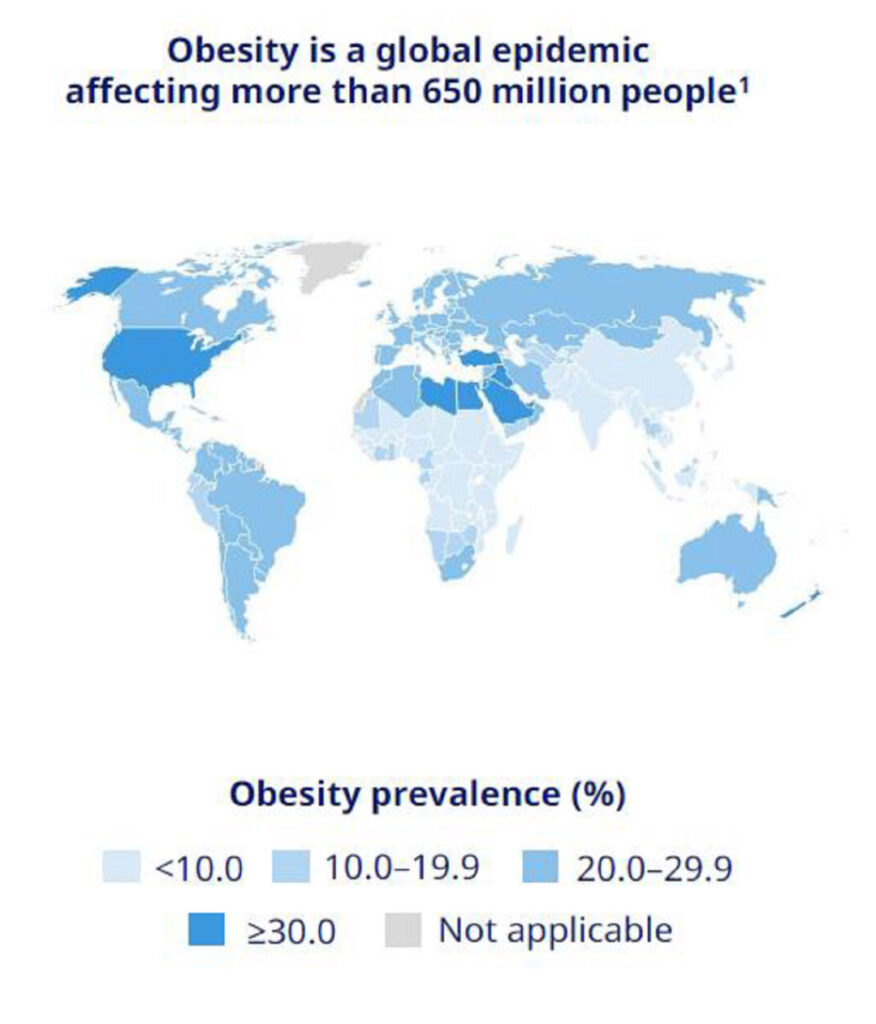

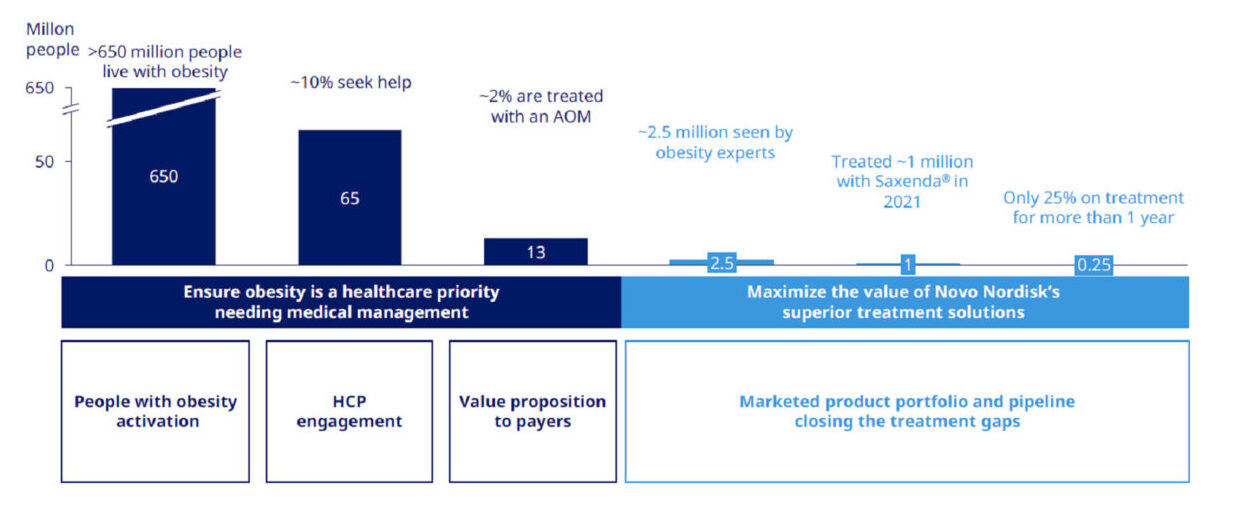

With so many obese people in the world the opportunity for the drug appears to be very significant.

Source: Handelsbanken

The consensus for analysts is that GLP-1 sales will reach $100 billion by 2031 and that Novo will command a 45% market share.

But is this realistic? We are sceptical for a number of reasons.

Let’s us just try to use our common sense for a moment…

1/ Are we really going to prescribe $100 billion of drugs for conditions that can be largely remedied by eating less and doing more exercise.

2/ And is it likely that the GLP-1 market is going to be two-thirds the size of the $164 billion cancer industry. A disease that kills and can’t be cured by eating less and exercising more…

3/ Looking at it another way, the world’s largest selling drug in 2022 was HUMIRA with $21.6 billion sales. HUMIRA is a monoclonal antibody used to treat all sorts of miserable conditions such as rheumatoid arthritis, ankylosing spondylitis and Crohn’s disease. Can it really be correct that Novo’s GLP-1 sales will be almost twice large.

4/ Many say that it will reduce the incidence of heart disease and lead to significant cuts in heart related healthcare spending. The problem, however, is that once you stop taking Wegovy you rapidly put the weight back on. At $1,350 per month (US list price) are you really going to take Wegovy for life and suffer all the side-effects (more anon…). And at best maybe you delay by a few years the incidence of heart disease. But that cohort may well become susceptible to the more-expensive-to-treat cancer as they live longer?

But the enthusiasts among you will say that I am just a fat-denier?

Well let’s go into the detail…

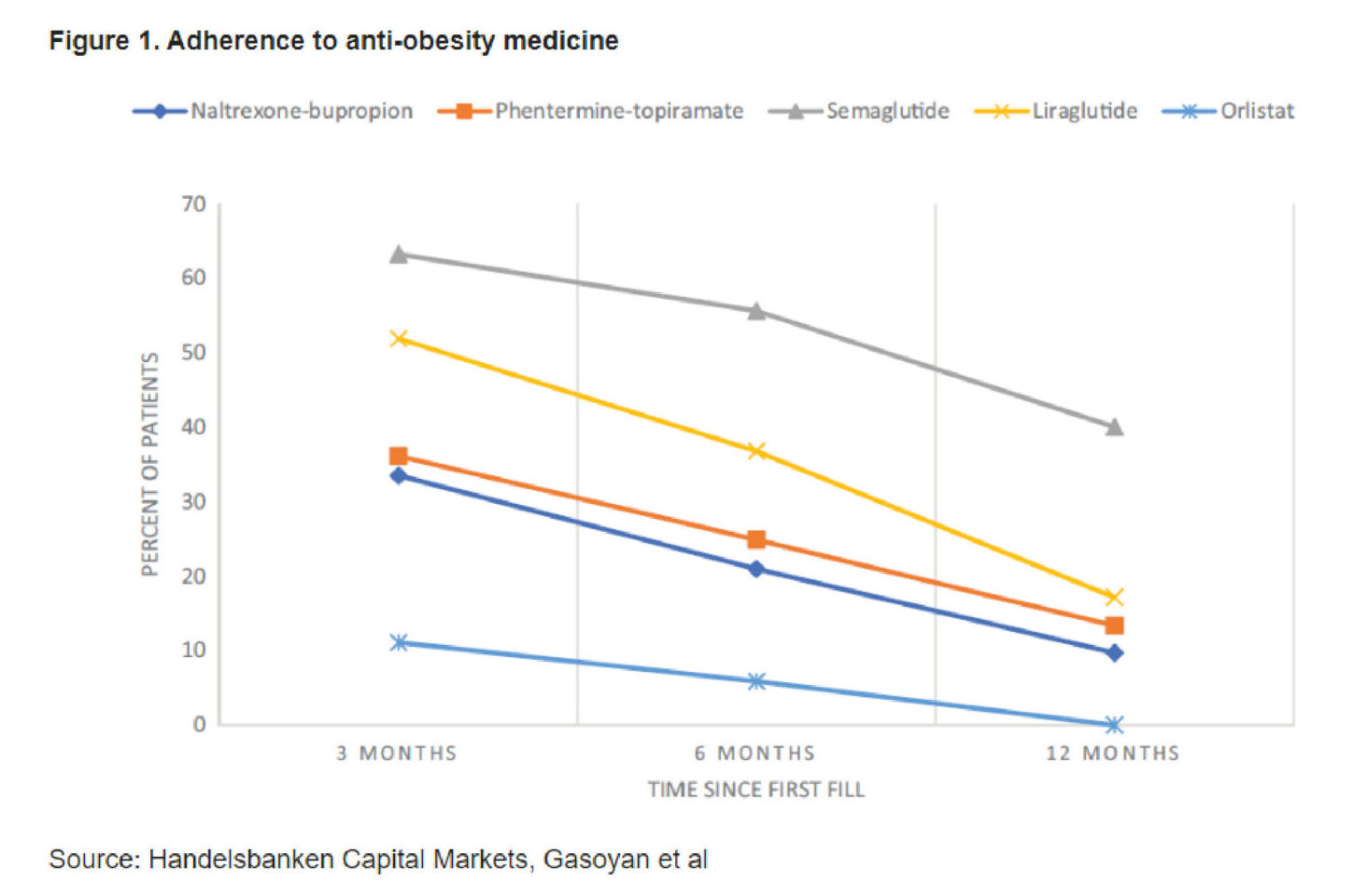

5/ And this is important. Novo Nordisk say that patients are most likely to take the drug for four years. Independent research suggests something very different. A recently published Obesity Society study into ‘Early-and later-stage persistence with antiobesity medications’ link found that only 19% of patients remained on treatment after one year. Wegovy had the highest one-year persistence but still only 40% remained on the treatment after one year. Novo has said that they will present stay time data for Wegovy sometime in 2024…

6/ As we mentioned, most analysts expect Novo to have a 45% market share of the GLP-1 market (67% of expected 2028 Novo sales). But at the last count, there are currently 74 drugs in development…So many that Johnson and Johnson’s CEO, Joaquin Duato, said that ‘it’s too crowded for us’.

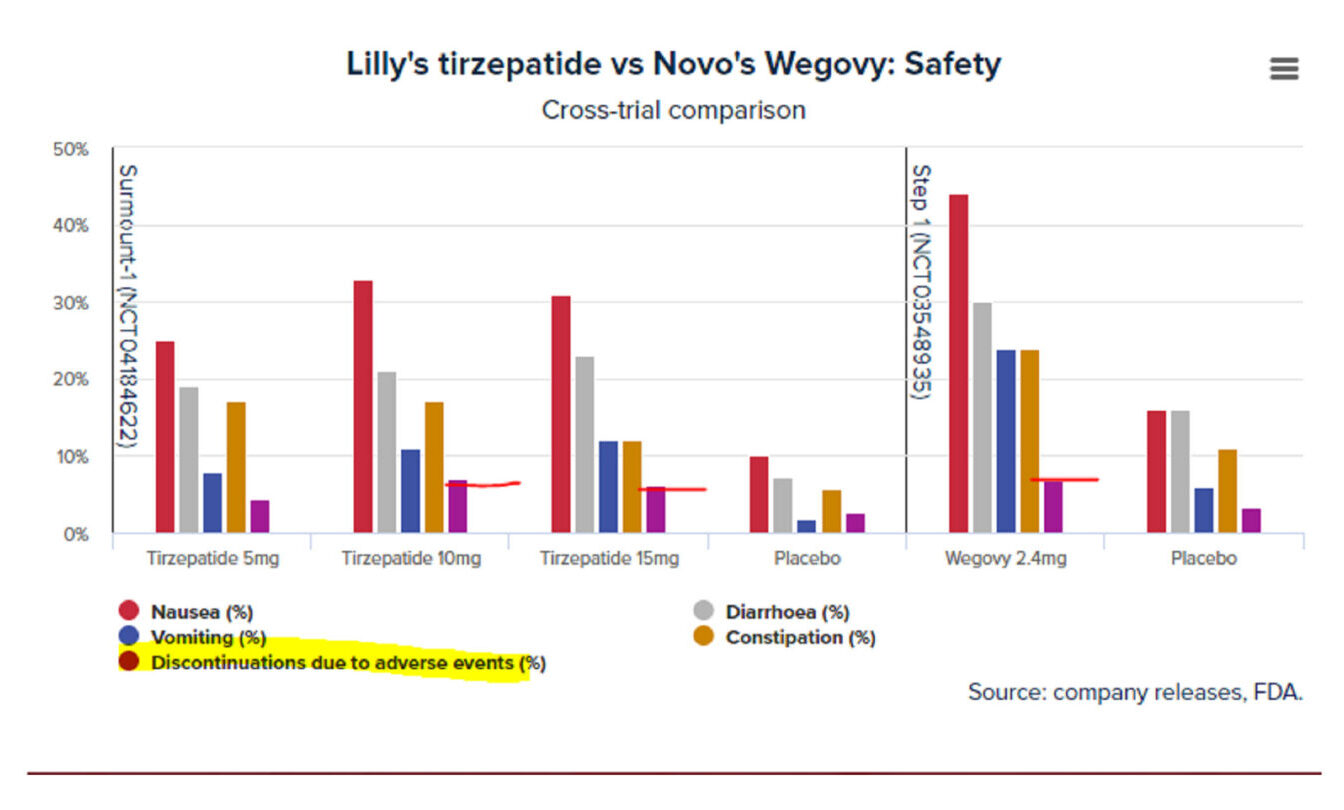

7/ But even if the market was to remain dominated by Novo and Lily, the Lily molecule seems to be more effective. A recent study into the ‘Comparative Effectiveness of Semaglutide and Tirzepatide for Weight Loss in Adults with Overweight and Obesity in the US’ link showed that the Lily drug was ‘significantly more likely to achieve 5%, 10% and 15% weight loss and experience larger reductions in weight at 3, 6, and 12 months’.

Source: Handelsbanken

8/ An this is where it gets interesting. Did you know that 75% of all anti-obesity drug users are women? So we may well be looking at a market that is somewhat smaller than thought. Have a look at the BBC documentary The Skinny Jab Uncovered link. You may be surprised to learn that Semaglutide is freely available at knock-down prices in beauty salons across the country. There are even Tiktokers who sell it?! Have a look at the Forbes article link.

9/ So that leads us to the question of pricing. Budget Semaglutide seems to be freely available at an 80% or so discount to prescribed Wegovy. This must somehow undermine the price of the drug? In addition, The Inflation Reduction Act gives the power to the US government to negotiate prices for the largest Medicare drugs from 2026. But before then a ‘maximum fair price’ will be set for Wegovy in February 2024 which some analysts believe could lead to a greater than 25% price reduction.

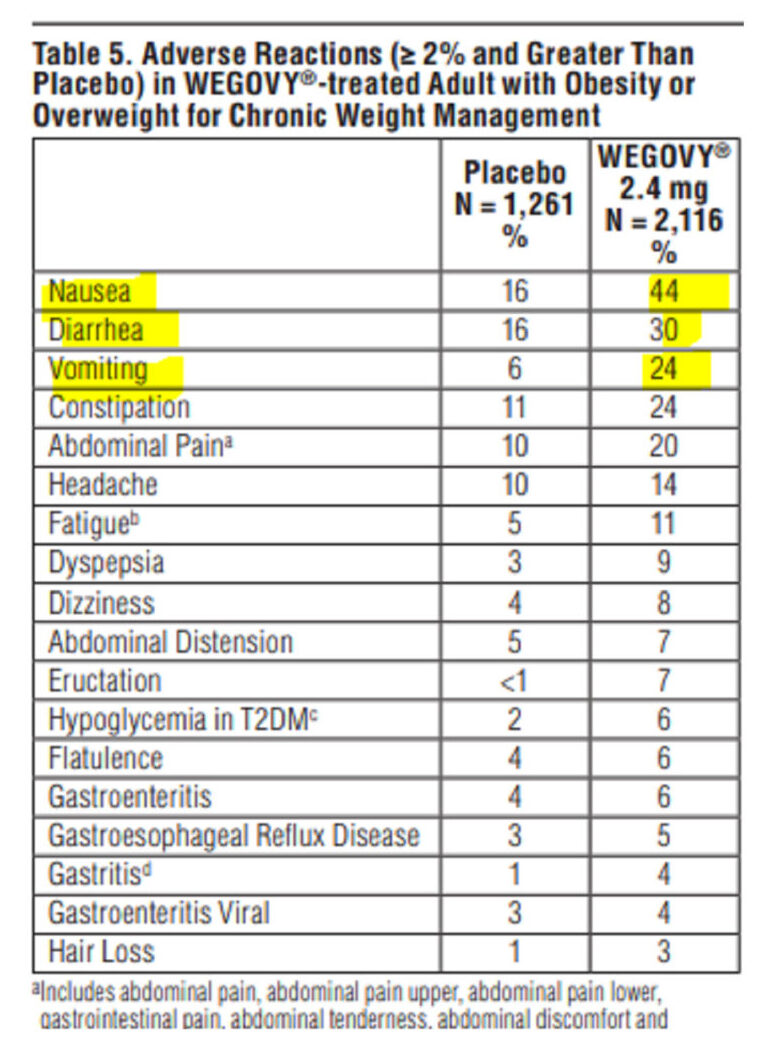

10/ And we haven’t got to the side-effects yet. Wegovy and other GLP-1’s are linked to nausea, vomiting and diarrhoea.

Source: Handelsbanken

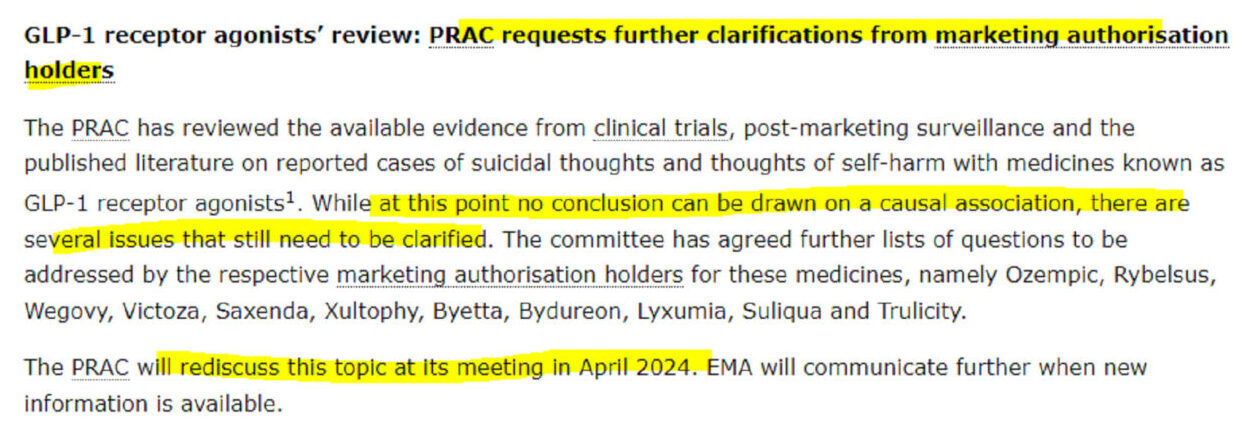

There may also be a risk of thyroid cancer and suicidal thoughts. The FDA has received 265 reports of suicidal behaviour from patients taking GLP-1’s since 2010.

Source: Handelsbanken

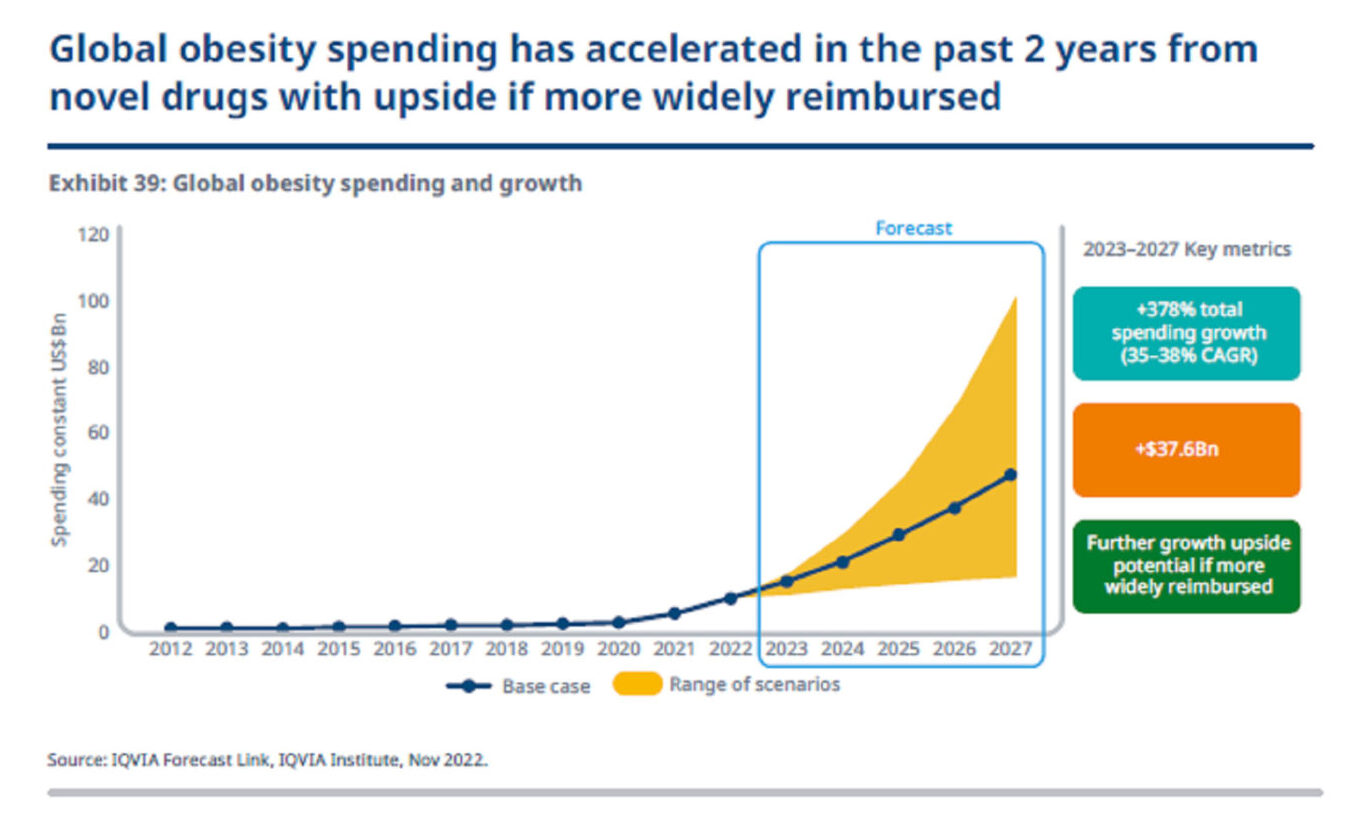

11/ So how big will the GLP-1 drug market really be? The modelling is fiendishly complex but for all the reasons that we discussed the market is likely to be a lot smaller than consensus forecasts of $100 billion sales. A leading in life science consulting IQVIA, estimated that the market could be worth anything between $17 billion and $100 billion.

Source: Handelsbanken

Let’s say that stay rates are a year (not four), that Novo end up with say a 10% market share, that the cohort is predominantly female and that pricing is lower than expected…Then hey-presto Semaglutide could end up as $5-10 billion blockbuster. Still a big drug but not the $47 billion mega-drug that many expect.

Members, log in below to access the restricted content.

Not a member?

Thank you for your interest. Please note that MOI Global is closed to new members at this time. If you would like to join the waiting list, complete the following form:

Disclaimers: This does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. This information generated by the charts, tables, and graphs presented herein is for general informational and general comparative purposes only. This document may contain forward-looking statements that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and investors may not put undue reliance on any of these statements. References to indices or benchmarks herein are for informational and general comparative purposes only. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. The information in this presentation is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. Each recipient should consult its own tax, legal, accounting, financial, or other advisors about the issues discussed herein.

About The Author: Stuart Mitchell

Stuart is the Managing Partner and CIO of S. W. Mitchell Capital and the Investment Manager of two funds, as well as a number of managed accounts. Prior to founding SWMC in 2005 Stuart was a Principal, Director and Head of Specialist Equities at JO Hambro Investment Management (JOHIM, now Waverton Investment Management). At JOHIM he set up and managed the Charlemagne Fund, a long/short European fund, and the JOHIM European Fund, a long only European fund. The JOHIM European Fund was number 1 rated by Micropal within its sector and three star ranked by S&P.

More posts by Stuart Mitchell