This article is authored by MOI Global instructor Krish Mehta, investment analyst at Enam Holdings, based in Mumbai, India.

Krish is an instructor at Best Ideas 2024.

Much has been written and spoken about India’s ascent as an emerging economy and about the Indian stock market over the past few months. However, if we assess the fundamental drivers for India to become a $10 trillion economy by 2030, there is a lot of merit to the attention the country is drawing currently.

With a per capita income of $2600 slated to go to $4000 by 2028 (as per IMF), and favorable demographics with a median age of 28[1], supported by a strong fiscal position, India seems to have all the structural drivers in place.

While the argument can be made that the structural factors have always been in India’s favor, what is different this time?

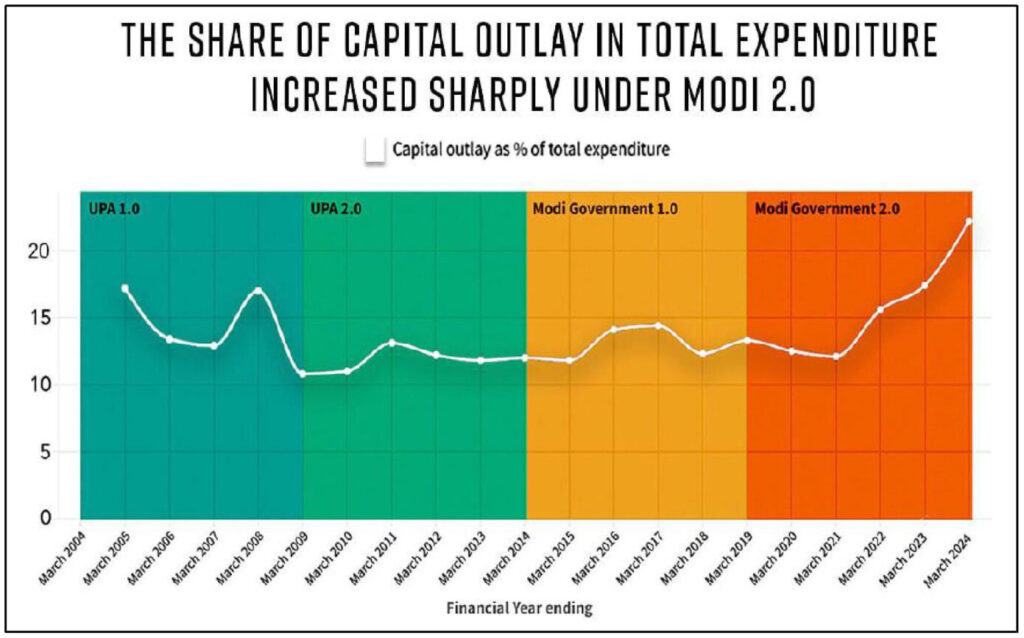

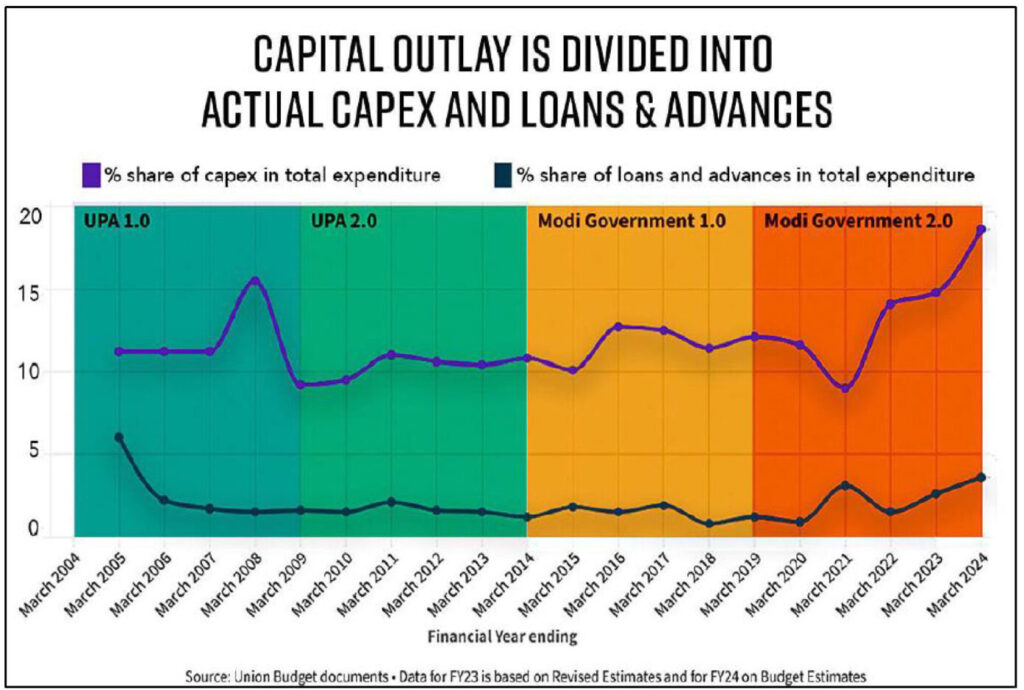

There are several factors that have dramatically changed from the past, which are part of the evolution in a developing economy. Firstly, there has been a strong government push on capex and a reduction in wasteful expenditure. Analyzing the data over the past four political regimes in India spanning two decades, the data shows the increasing focus on capex and infrastructure (as seen below).

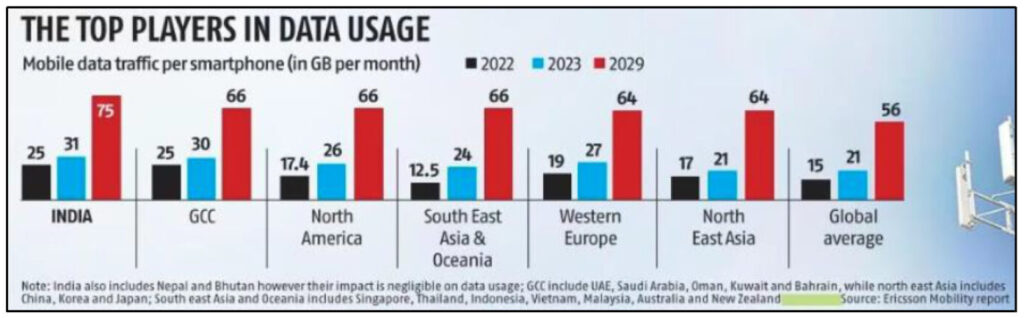

Given this capex push and focus on infrastructure, the government is translating policy goals into action. Infrastructural development and bridging the gap between rural and urban India is a key foundational pillar for the path to $10 trillion. Moreover, every Indian has been given a unique digital identity through Aadhar. With the linkage between Aadhar and new bank accounts particularly for new to bank customers, India has seen a rapid adoption of digital payments and efficient transfer of government subsidies to the target beneficiaries. Today, India has over a billion mobile phone users and consumes the highest mobile data per smartphone user in the world (as seen below).

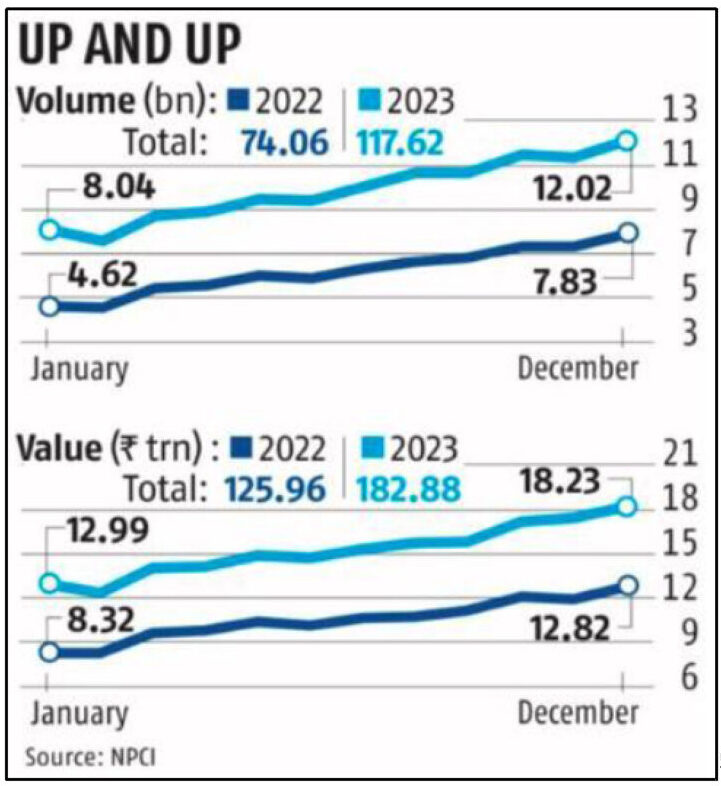

The widespread digital adoption in India is evidenced by the success of UPI (as seen below).

With GDP per capita forecasted to rise from $2600 to $4,000 by 2028, credit growth will be central to India’s economic growth. The banking sector will be critical for India’s incremental growth ambitions in the coming decades and is poised to take off.

If the economy were to grow at 7-8% p.a. in real terms and 11-12% in nominal terms, credit growth will be in the mid to high teens for sustainable and well-rounded economic growth.

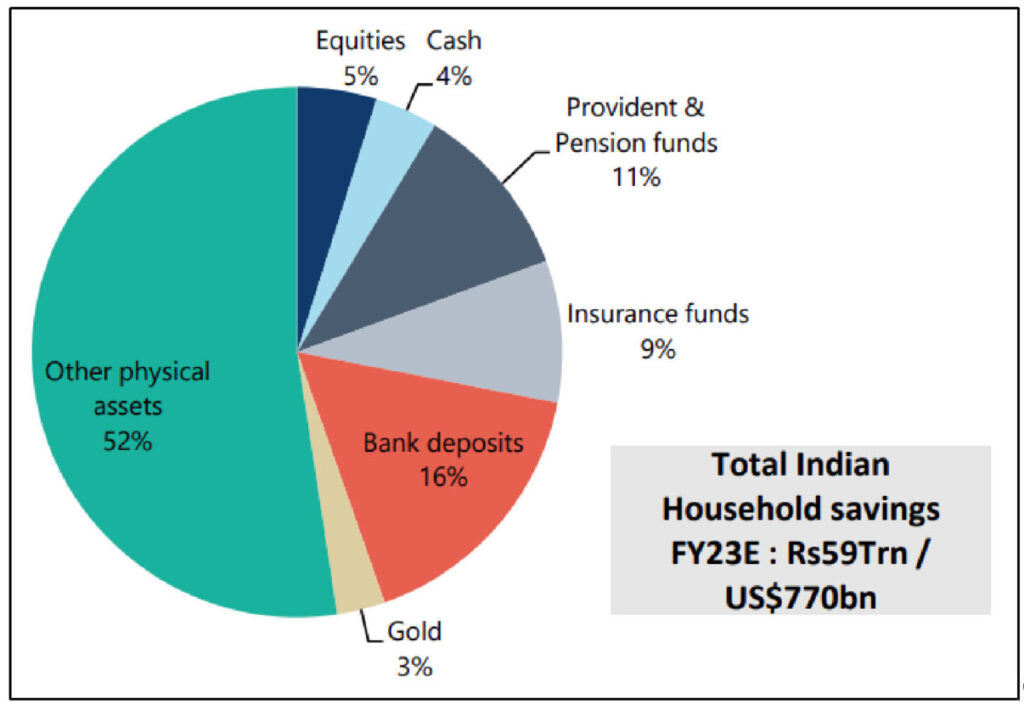

The table above shows the household assets in India by asset class. Given the low level of financial assets compared to physical assets, there is tremendous room for the financialization to go up in India. The financialization trend will be driven by bank deposits, insurance funds, pension funds and equity investments. As this share goes up with incremental household savings being invested in financial assets, banks will play a fundamental role and grow at a multiplier of nominal GDP growth (mid to high teens).

While viewing the market share dynamics, the high market share of public sector banks in the economy’s banking system (65%), leaves plenty of room for efficient private banks to gain market share and grow their businesses. One such private bank that has been the best-in-class lender for over two decades is HDFC Bank. Post the merger with HDFC Limited (it’s parent mortgage entity), the bank has a behemoth balance sheet of $300 billion and a market capitalization of $150 billion.

Having produced best in class growth (20%), ROA (2%), ROE (20%) and having maintained a highly conservative risk framework since inception, HDFC Bank is best placed to capitalize on the ongoing economic growth India is witnessing and will witness in the coming decades. It will play a central role in India’s growth ambitions, as validated by RBI’s classification of the bank as a Domestic Systemically Important Bank.

[1] World Population Prospects (WPP)

[2] https://theprint.in/economy/rising-capex-share-falling-subsidy-burden-how-modi-govts-spending-priorities-differ-from-upas/1896931/

[3] https://theprint.in/economy/rising-capex-share-falling-subsidy-burden-how-modi-govts-spending-priorities-differ-from-upas/1896931/

[4] Ericsson Mobility Report 2023

[5] NPCI

[6] RBI, AMFI, Jefferies

About The Author: Krish Mehta

Krish Mehta is a value investor from Mumbai, India. He is an Investment Analyst at Enam Holdings in Mumbai, a reputed family office. Enam runs a concentrated book and takes five- to ten-year views on businesses, practicing a long-term value-focused investment philosophy. Krish’s role at Enam is conducting bottom-up, fundamental research of Indian and global equities across sectors, portfolio management, and covering global macro. Krish graduated from the NYU Stern Undergraduate School of Business in 2019 with a BS in Finance and Accounting and interned at a long/short hedge fund in London, Theleme Partners, for two summers prior to joining Enam.

More posts by Krish Mehta