This article is authored by MOI Global instructor Stuart Mitchell, investment manager at S. W. Mitchell Capital, based in London.

Source: Sky News.

Source: Sky News.

As interest rates continue to move higher, particularly in the UK, I thought that it might be worth to take a look at mortgage affordability.

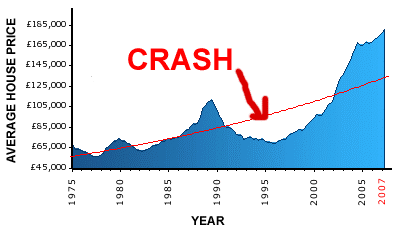

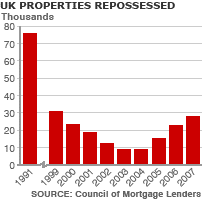

Those of us who are old enough will remember the collapse in the UK residential (and commercial) property markets in the early 1990’s. The slump was so deep that almost 200,000 homes were repossessed between 1991 and 1993. So with interest rates rising to 5% in the UK – and most likely higher still – many now fear that we could now see as many repossessions as we did then.

Source: Landlord Blog.

Source: Landlord Blog.

Source: BBC.

Source: BBC.

We disagree.

In the 1980s Margaret Thatcher’s government gave council tax owners the right to buy their houses. This fuelled a housing market boom; by its end, over half of all house owners had a mortgage.

1979: Milton Keynes King’s family receives the deeds to their council house. Source: The Guardian.

1979: Milton Keynes King’s family receives the deeds to their council house. Source: The Guardian.

The housing market couldn’t look more different today. Now, just 28% of house owners have a mortgage. And, crucially, according to Goldman Sachs, 91% of outstanding mortgage debt is held by households with above-median incomes. This means that only 9% of families would have to change spending patterns if mortgage rates reached 7%. They make the further observation that excess deposits have grown by no less than £300 billion over the pandemic. This may been seen as money that could be used to pay down mortgages.

It is also worth pointing out that bank rate reached almost 15% in 1989, only gradually falling to just below 6% in 1993. Moreover, the majority of mortgages were floating rate – borrowers felt the pain of higher rates immediately. Today, over three quarters of all outstanding mortgages are fixed, a figure that rises to 90% in the case of new mortgages. The number of households which will be refinancing in 2023 is a comparatively modest 1.4 million. Equally important is that loan-to-value ratios are significantly lower than in the 1990s slump. Back then, a breathtaking 20% of recent buyers (1988-91) had negative equity by 1992 (in Luton South 72% were “negative equiters”!). Today, the industry leader Lloyds has an average loan-to-value of 42%. This will make the industry more comfortable helping borrowers who get into trouble. So far such borrowers have not been overwhelmingly numerous: only 1,250 houses were repossessed in the first quarter of this year.

Members, log in below to access the restricted content.

Not a member?

Thank you for your interest. Please note that MOI Global is closed to new members at this time. If you would like to join the waiting list, complete the following form:

About The Author: Stuart Mitchell

Stuart is the Managing Partner and CIO of S. W. Mitchell Capital and the Investment Manager of two funds, as well as a number of managed accounts. Prior to founding SWMC in 2005 Stuart was a Principal, Director and Head of Specialist Equities at JO Hambro Investment Management (JOHIM, now Waverton Investment Management). At JOHIM he set up and managed the Charlemagne Fund, a long/short European fund, and the JOHIM European Fund, a long only European fund. The JOHIM European Fund was number 1 rated by Micropal within its sector and three star ranked by S&P.

More posts by Stuart Mitchell