Alex Furmanski of Unison Asset Management presented his investment thesis on CDW Corporation (US: CDW) at Wide-Moat Investing Summit 2023.

Thesis summary:

CDW is a value-added reseller (VAR) of IT products to small- and medium-sized businesses in the US, Canada, and the UK. It is the largest VAR in the US at almost three times the size of its nearest competitor.

CDW consistently earns returns on capital in excess of 25% due to low capital intensity (capex is only 1% of sales). The company’s moat stems from its scale, which allows CDW to get more favorable pricing from partners. EBIT margins of 7.5% are almost twice the level of peers. Smaller competitors, with margins of roughly 3%, struggle to beat their cost of capital.

The VAR industry is highly fragmented, with CDW having only 5% share of the addressable market. The company has outgrown the US IT market by 300+ basis points since 2009. CDW’s runway for growth is ample, and Alex expects the company to continue gaining share from smaller players and benefiting from higher IT spending trends.

With the shares trading at under 18x 2023E consensus earnings, Alex believes the shares offer compelling value.

This session is also available as an episode of Discover Great Ideas, a member podcast of MOI Global. (Learn how to access member podcasts.)

The following transcript has been edited for space and clarity.

Alex Furmanski: I joined the MOI community over 10 years ago, but I had not engaged actively until recently. I have attended several of your in-person events and found the quality of the people to be great. Hopefully, the idea I’m presenting today adds to the discourse. I very much look forward to continued engagement.

Let me start with a brief overview of our company. Unison is a long-only, concentrated public equities partnership. Our portfolio is typically made up of 20 to 25 positions with a U.S. bias spanning across market caps and sectors. The firm was founded in 2017 and is based in Miami. We currently have $175 million in AUM. Our approach is pretty straightforward. We use a private owner mental model to find great businesses with durable competitive advantages. We look to buy these companies at attractive prices with a sufficient discount or margin of safety to their intrinsic value, then hold them for as long as they stay great, which can range from several years to ideally forever.

Throughout our process, there are two main questions we try to answer. The first one is how good the business in question is, and the answer can be poor, average, good, or great, which is largely a qualitative exercise. The second question is how much the business is worth. Ultimately, we determine that by building a DCF. It’s a largely quantitative exercise, but as we know, an Excel spreadsheet can tell you whatever you want to know. The output is only as good as the variables you’re putting into it. This is where we spend the majority of our time during our research process.

To answer these two questions, we look at four pillars. Number one is product. A question we love to ask ourselves is, “If the product or service of the company we’re looking at were to disappear tomorrow, would anyone miss it?” We try to quantify the unit economics of the product and define the value proposition for the customer. Our goal is to hone in on the key value drivers and get a sense of how these might change going forward.

In terms of people, alignment is critical. Ideally, the companies we invest in have a large insider ownership. We look for good capital allocators. Here, we pay a lot of attention to their historical track record. Are they buying back shares constantly to avoid dilution from stock options? Is it more opportunistic based on the stock price?

The third pillar is the balance sheet. Here, the emphasis is making sure the business has a thoughtful capital structure that can withstand hard times.

Lastly, we consider the moat. We’ve developed a framework largely inspired by the work of Michael Porter, who is the patron saint of competitive analysis, if you will. We like to call it our CAF – competitive advantage framework. It forces us to grade the intensity of the competitive forces within an industry, and, to the extent possible, qualify the source and durability of a business’s competitive advantage.

The output of this process is what we call our tiered list, which contains what we believe to be the best businesses to own in public markets across the world. That list has a little south of 100 names on it. Many times, what we do is observe them and wait for Mr. Market to present us with a price that makes sense.

In terms of what makes Unison different, there are three key things to highlight. The first is alignment. The owners of Unison are the largest investors in our funds. We have the preponderance of our liquid net worth invested in our funds. We have family, friends, and close people invested as well. In short, we do eat our own cooking.

Two, we’ve actively sought out a like-minded capital base that allows us to invest patiently and prudently for the long term. This is a critical point. For example, last year, which was a very difficult one in the markets, we came out fairly well. The reason is that we avoided paying high prices for many of the businesses on our watch list because we have patient capital.

Last and somewhat tied to this is our unique style. We saw in a recent presentation from a peer that we’re definitely in the minority. How do we define that? They came up with a study where they quantified that only 1% of money in global equities is invested using a concentrated value investing approach like ours. That’s defined as one position greater than 5% and annual turnover of less than 30%. If you look at our portfolio today, probably a third of the names have been with us since we started managing capital on our own in 2011. The turnover in our portfolio is south of 15%. Tying this back to this summit, the only way you can truly invest for the long term is by emphasizing moats.

With that prelude, let me jump straight into the idea we’re presenting today, CDW Corp. The cover of Forbes magazine in November 1998 featured the title “Artificial Intelligence Gets Real.” The company profiled in that issue was pcOrder.com, and unless you were active in the markets back then, you probably don’t recognize the name because the company no longer exists. We’re here today to talk not about high tech defined as artificial intelligence. We’re here to talk about low tech. The key message is that boring can often be better in investing and that hype and narratives often get blown out of proportion.

Since CDW’s second IPO in 2013, the company’s stock has done fairly well. It has gone up by 833%, which is a CAGR of 25%. We’ve been fortunate enough to own it since the pre-Unison days, buying our first shares in 2014. In contrast, pcOrder’s stock peaked at around $80 in 1999 and subsequently went essentially to zero.

What does CDW do? The company is the largest value-added reseller (VAR) of IT products to small and medium-sized businesses in the U.S., Canada, and the U.K. Essentially, it helps tech companies of all sizes sell to small and medium-sized businesses as well as smaller government clients. Its vendor partners range from mega tech incumbents such as Microsoft and Cisco to new challengers such as Splunk and Five9. CDW sells over 100,000 products from over 1,000 partners. Its reason for existence is that the customer base is highly fragmented, and it would be very impractical for IT vendors to reach it with their own sales forces, which usually focus on the bigger fish.

Would suppliers care if CDW vanished from the face of the earth tomorrow? I think the answer is unequivocally yes. The top five vendor partners do over a billion dollars in sales through CDW, and the next 15 vendor partners do over $100 million in sales. CDW is an extremely important partner for a lot of these tech companies. If you look at the entities that CDW works with, the list reads like a Who’s Who in the tech world. Pretty much every tech company you can think of works with CDW, including many of the AI providers that are in the news lately.

The company is headquartered right outside of Chicago. It had $24 billion in net sales in 2022, over 250,000 different customers, and 15,000 employees. It sits at number 166 on the Fortune 500 list. It is primarily a U.S. business, but it has expanded in more recent years, mainly because customers were requesting it in the U.K. and Canada.

One of the things we try to do when looking at a prospective investment is to understand the company’s history so we can understand its DNA. CDW was founded in 1984. It first IPO-ed in 1993. At the time, it had slightly south of $300 million in sales and 250 workers. By the time it switched from being a catalog-only provider to selling online in 1995, it had already reached over $600 million in sales. By 1997, it had surpassed a billion in sales and had roughly 1,000 workers. In 2001, it made it onto the Fortune 500 list at number 435, at which point it had almost $4 billion in sales. In 2007, the company was LBO-ed by Madison Dearborn – it then had $8 billion in sales and over 6,000 employees.

In 2013, CDW went public for the second time. By that point, it was generating $11 billion in sales and employing 7,000 people. Today, the company is making around $24 billion in sales and employing over 15,000. This is a company that has compounded its top line at 29% CAGR since inception and grown its worker count at a similar rate. Quite a journey and quite a history.

What is CDW’s value proposition? It is far more than a hardware seller. The company plays a critical role in designing, deploying, and providing after-market support for the IT infrastructure that it helps its partners with. It is an agnostic partner. When a customer comes to CDW with a problem, the company does all the technical work. It does the price comparison and determines what might be the best solution for the customer, be it on-prem, hybrid, or fully in the cloud.

CDW is incentivized to work within the parameters a customer provides because it is vendor-agnostic seeing as it works with pretty much all of the tech ecosystem. It can truly focus on what’s best for the customer. From the customer’s point of view, it makes CDW more efficient. It’s hugely impractical for a customer to vet and negotiate with dozens of different IT vendors, so working with CDW allows them to focus on their core efforts.

From 2013 through the first quarter of this year, CDW has made a very nice progression in terms of the top line, growing its net sales at 9% CAGR. In terms of gross profit, the CAGR is two points above net sales, which translates into a bit of operating leverage at the EBIT level. Progress has been even better on the net income front, with a CAGR of 17% on a non-GAAP basis. The net income differential CAGR is mainly due to the company being an LBO. As it paid down debt, that accrued and gave it more of a kicker.

Something I’d like to highlight is that the one constant in business is change. CDW has evolved from a pure hardware catalog seller to a seller of software and services as well, which has been accretive to margins. When the net revenues include these categories, which are now almost a third of sales, margins go from historically the mid-7% range to closer to 9% now. Another point is that the CAGR in the stock price has definitely benefited from multiple expansion. It’s mainly been driven by earnings growth, which is what we love to see as investors.

In terms of the customer breakdown, more than 50% of sales comes from corporate and small businesses. The sweet spot for CDW is businesses with fewer than 5,000 employees. Overall, sales are fairly well diversified. Government, education, and healthcare, which tend to be much less cyclical, make up an important part of the revenue stream. This is significant because IT spending is cyclical. When you hit a bump in the road, as in 2008, the corporate segment goes down – I think it was down more than 20%. At the same time, however, in 2008 and 2009, the government and education business grew. It’s important for the stability of earnings to have a diverse set of customers.

Now comes the fun part – talking about the moat. Allow me to lead with the following quote from Warren Buffett: “The key to investing is not assessing how much an industry is going to affect society or how much it will grow but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” I often find commentators in public markets miss this. It seems to be a continual search for growth – mainly top line growth in at least the short-term momentum of stock prices.

This quote is very powerful. Let me tie it back to something else Buffett said in a speech in 2001. He made the very interesting point that if you knew at the turn of the 20th century that horse carriages were eventually going to be displaced by cars, you’d not necessarily have made any money investing in the leading car makers of the time. In the 1920s and 1930s, there were three auto companies in the Dow Industrials – Studebaker, Nash-Kelvinator, and Hudson Motors. None of these companies exist anymore. Figuring out the economic characteristics of the winners in a growing business is not necessarily easy. I think that point is lost on many observers, commentators, and investors.

What’s the source of CDW’s moat that has allowed it to deliver such spectacular numbers? It comes down to scale. At Unison, we consider scale to be one of the strongest sources of moat. As it relates to CDW, it’s three times the size of its next largest competitor. This allows the company to get favorable pricing from its vendor partners and to have an EBIT margin more than twice that of its peers it’s 8.5%. While CDW thrives, a lot of its competitors struggle to beat the cost of capital at margins closer to 3%.

The second point related to scale is that CDW has 6,400 technical workers who can be brought to bear on any project a client might have. As IT solutions become more complex, the need for these capabilities increases, and so does the moat around CDW. Smaller competitors don’t have the same resources as CDW.

Somewhat tied to this is talent. If you look at the revenue per employee of CDW versus its two closest public competitors, Insight and PC Connection, you’ll see that the productivity of CDW’s employees is significantly higher. This becomes a virtuous circle where the best and brightest talent in the industry wants to work at CDW because they can make more money there.

How does the moat translate into returns? I’ve looked at a graphic from CDW showing the return on working capital. The company has very negligible tangible capital. Its capital is really its people. The capex spend as a percent of sales is less than 1%. The numbers are pretty impressive. We tend to focus a little more on return on incremental invested capital. For CDW, that metric is closer to the mid-20s range, which is still very attractive.

What’s the opportunity from here for CDW? The total tech stack spend in the U.S., the U.K, and Canada – the markets where CDW operates – is $1.4 trillion. Obviously, CDW doesn’t address all of this, but it does address roughly half a trillion dollars of spend. Given that its sales are at $24 billion, it controls around 5% of its total addressable market. What’s very interesting is that from 2006 through 2022, CDW’s net sales have outgrown U.S. IT spend by over 200 basis points per year. That accelerated after the 2009 crisis, with the company’s net sales growing over 300 basis points a year higher than the underlying market. There is a long runway for CDW to continue to grow and thrive.

Let’s turn to the valuation. The company is currently trading at a pretty reasonable value – 18 times consensus earnings estimates for 2023. To assess the margin of safety on this investment, we considered what penetration level of IT spend by increments of 100 basis points does to the valuation, both on a P/E and EV/EBIT basis. For example, if the company gains 100 basis points of market share, the effective multiple you’ll be paying is not 18 times but rather 15 times and the EV/EBIT is 12. If you believe that CDW will continue to gain share – which we do – the true multiple becomes a lot more palpable than the headline multiple.

Another key point is alignment. In this case, management has significant skin in the game. They own shares worth roughly $55 million. Interestingly, the CEO has bought around $2 million at current levels, including a buy in the last month. One thing we like to do when looking at a new situation is study the proxy statement and truly understand how management teams are being compensated. All human beings react to incentives. If boards are measuring the wrong metrics, you might end up with results you don’t like as a shareholder. In CDW’s case, we have a nice example of management comp structured to incentivize and align the management team with us as minority shareholders.

I’ve given you a lot of the reasons why you should buy CDW. Let’s now balance it with some of the risks. The first risk you’ll probably read about if you do a bit more research – at least perceived risk – is the transition to the cloud. The fear is that as more spend moves to the cloud, there’s less money to spend on on-prem servers and things like that.

What’s interesting is that the cost of running a whole IT structure on the cloud is not trivial. Some believe the total addressable market of these cloud companies is somewhat overhyped. For instance, when Dropbox went public in 2017, it alluded to $75 million in cumulative savings over two years prior to the IPO by optimizing its IT infrastructure and repatriating workloads from the public cloud into its own cloud. If you look online, you’ll see many other examples of companies that start working with the cloud, then all of a sudden, they see the size of the bills and decide that some of the workloads are better in the cloud and some are better on prem. The large cloud providers would lead us to believe that the TAM might be a lot bigger than it is.

There are other considerations – regulation, security, and control of the data also play an important role. We believe the transition to the cloud is not a zero-sum game. There’s definitely going to be an important part of workloads done in a hybrid-type environment. Even if you believe that everything will ultimately migrate to the cloud, companies will still need help integrating different cloud environments with different middleware. Most won’t put all their eggs in one basket, which would still leave CDW and other VARs with a pretty important role to play. That’s risk number one.

Risk number two is more of a near-term risk to earnings than anything else. The company – like many others – is cyclical and in a slowdown like the one we see now in the U.S. economy and tech spend, especially after the COVID madness. This impacts CDW. In the last month, it came out with a profit warning of sorts, saying that it expects the U.S. IT market to decline high single digits in 2023. The company still expects to outgrow the IT market by 200 to 300 basis points. Nonetheless, that’s a revision from its original guidance at the beginning of the year. That in and of itself is a short-term earnings risk. It’s somewhat discounted already in the stock price.

What’s nice about CDW is that since it’s very capital-light, it has a very flexible cost structure. A big part of its costs is sales commissions to its workers. As sales volume declines, so does this lever. For instance, during the GFC, revenue went down 11%, and EBIT was down 30%, but this isn’t a company that will lose money at the bad part of the tech cycle, as a lot of other tech companies might.

The third risk is leverage. We believe it’s manageable. The company is 2.5 times levered, but given the variable cost structure, it still has ample EBIT coverage on its balance sheet even in a bad environment.

The last one is execution. CDW has become more acquisitive in recent years, but its track record has been great in comparison to the track record of M&A in corporate America, which is abominable when you look at the statistics. Most importantly, management is being prudent in terms of capital allocation, with acquisitions not set on autopilot but only done when the right opportunity exists. For instance, CDW’s entrance into Canada and the U.K. was driven in large part by existing customers asking for solutions in those markets.

In conclusion, you have a best-in-class VAR trading at a below-market multiple with a long runway for growth at attractive ROICs. We’ve held it for nearly 10 years, and we hope to hold it for at least another 10.

The following are excerpts of the Q&A session with Alex Furmanski:

John Mihaljevic: On the capital allocation front, is there anything you might prioritize differently compared to what management is doing?

Furmanski: The answer is no. We’ve seen companies make all types of moves on the capital allocation front. I think CDW’s management have been extremely thoughtful in balancing share repurchases and M&A, acting only when it makes sense. We firmly believe that great opportunities in investing don’t come along every day. You’re lucky if you get a handful every couple of years. CDW has had the discipline to wait for those.

We like what the management team have done in terms of capital allocation. I think a lot of it has to do with the fact that they have their own egg nest in it, as we do.

Mihaljevic: In terms of data points to keep an eye on here to gauge how the thesis is playing out over time, what would be the key items to watch?

Furmanski: Return on incremental invested capital is always something we keep an eye on. Being mindful of spending cycles for different businesses, it’s a little different in the case of CDW because the capital spend is so light that it doesn’t affect that, but it definitely bears watching it in other businesses.

For this one in particular, return on incremental invested capital for us includes M&A spend and market share versus the broader IT industry in the United States. You can get those numbers from different providers – Gartner, IDC, etc. There’s a lot of public data on how much IT spending is growing; you can compare it to CDW to continue to track that thesis of market share growth, which has been unfolding very nicely over the last couple of years. We’d expect that to continue into the future.

Mihaljevic: In terms of the valuation, could you elaborate on how that compares to the historic range and how you would rate this opportunity through time? Is this a particularly good time to get long here?

Furmanski: We think it’s pretty interesting value at this point. Is it the cheapest it’s been in the last 10 years? No. When we first bought it, I think it was south of 14 times PE multiple.

The broader markets have had a lot of multiple expansion since then, but it is what it is. When you compare it to the broader S&P today at 20 times earnings, CDW is trading at a discount at 18 times. We believe it’s a company of higher quality. Most importantly, we believe the runway ahead of it is pretty long.

Mihaljevic: You described the moat quite eloquently. I’m wondering whether you could comment a bit further on the perennial view that these kinds of VARs are bound to get squeezed over time, that maybe in the very long term there may not be a need for these types of players. That’s been a charge for quite a while. It hasn’t panned out, but maybe you could provide a little more color on that for the very long term.

Furmanski: We go back to the quote that “the only constant in business is change.” Any business will require management teams to adapt to changing environments and circumstances. CDW started only with hardware, then it added software and more recently services.

We’ve done a lot of work and thought a lot about the question you asked. We come up with the answer that IT is not necessarily simplifying. Even though we now have AI and some of these things, IT is a pretty complex issue. This whole notion of on-prem, hybrid, middleware, integrations – in some capacity, I think it is making it somewhat more complex. The work we’ve done makes us fairly comfortable that there’s a place and a need for these companies.

Remember who CDW serves. These are smaller enterprises and customers that don’t have deep IT departments. They need help in understanding the solutions, pricing them, implementing them, and monitoring them. We don’t think that will go away.

A lot of the value comes from owning that customer relationship, having that trust, being on the approved vendor list. From the perspective of CDW’s vendor partners, you could ask, “Why would Microsoft not just go directly?” The answer is that the customer base is extremely fragmented, and Microsoft doesn’t want to distract itself from its core business. It doesn’t want to be providing support and service to thousands and probably even millions of customers.

We believe the need for VARs is here to stay. That doesn’t mean the VAR business model will be exactly the same 10 years from now, but that’s probably true for every business.

Mihaljevic: Alex, thank you very much for joining us and sharing this investment thesis with the MOI Global community. It’s been truly a pleasure.

Furmanski: Thank you very much, John.

About the instructor:

Alex Furmanski is a partner and investor at Unison Asset Management. He has more than two decades of professional investing experience. Prior to Unison, from 2011-2017, Alex was Managing Partner and Founder at Safe Harbor Investment Partners LLC, a private investment partnership focused on investments in public equities employing the same approach being used at Unison Asset Management. From 2005 – 2011 Alex was Senior Associate at Khronos LLC, a private investment partnership based in New York. From 2003 – 2005 Alex was an Investment Banking Analyst in the Global Healthcare Group at Merrill Lynch.

Alex was born and raised in Bogotá, Colombia. He earned a Bachelor of Science in Economics Cum Laude with a concentration in Finance from the University of Pennsylvania’s Wharton School in 2003.

The content of this website is not an offer to sell or the solicitation of an offer to buy any security. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment, or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information set forth on this website. BeyondProxy’s officers, directors, employees, and/or contributing authors may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated herein.

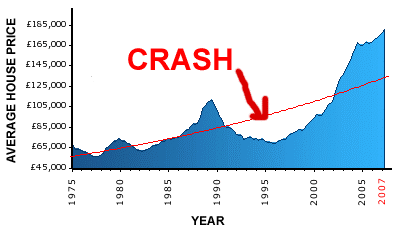

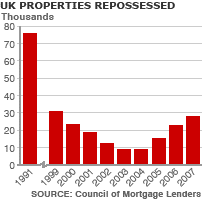

Source: Sky News.

Source: Sky News. Source: Landlord Blog.

Source: Landlord Blog. Source: BBC.

Source: BBC.