Simon Caufield of SIM Limited presented his investment thesis on International Workplace Group (UK: IWG) at Best Ideas 2025.

Thesis summary:

IWG (Regus) is by far the leader in the growing, fragmented market for flexible office space. Historically, Regus was a serviced office provider taking long-term leases from building owners to offer short-term leases to customers.

IWG is not WeWork, as it has been consistently cash generative (excl. growth capex); it survived the dot com crash, the GFC, and covid lockdowns. ~25% of revenue comes from ancillary services like coffee, parking, IT, and secretarial. IWG is 6x larger and more diversified than WeWork — more countries, brands, and suburban. Each property is owned within an SPV, so that IWG can terminate leases or negotiate rent breaks. 40% of lease liabilities are flexible, with rent linked to landlord revenue.

The market for IWG is growing, and the runway is long. Flex has reached only about 15% of the UK’s total office space. Simon estimates that the total addressable market is more than 1,000x IWG’s recent market cap.

IWG is uniquely positioned to serve two segments. In the traditional serviced office business model, providers take long-term leases from building owners and sell shorter-term, flexible leases to customers. Customers are mainly smaller companies and startups with needs for a single office. IWG also provides multiple-office/region/country options for large and multinational businesses wishing to reduce their commitment to long, fixed leases. Demand is growing for a flexible “work-close-to-home” alternative/complement to traditional offices and home working. Only IWG is able to offer these services because its network is so much larger, diversified, and suburban than the networks of competitors. While capital intensive, this business model has barriers to scale.

Since 2019, IWG has been transitioning to a capital-light model. It franchised its Japanese business for 3.4x revenue plus an annual royalty of 4-5% of “system revenue”. It has since developed a superior “managed” capital-light model, in which IWG manages spaces, including sales and services, which franchisees generally do less well. The annual royalty to IWG is typically 10-15% of “system revenue”, and landlords incur capex. This business model has barriers to scale and minimal capital requirements.

In March 2022 IWG announced the £270 million acquisition of The Instant Group, a private software company providing an Airbnb-like service for booking office space. IWG subsequently merged its own fledgling software businesses into the division and renamed it “Worka”. In November 2022, IWG rejected an offer from CVC of £1.5 billion for The Instant Group, equivalent to 137p per IWG share. Today, Worka generates annualised revenue of $376 million and EBITDA of $140 million.

Simon estimates that IWG could be worth 737p per share, or 4.6x the recent 160p share price. Worka alone may be worth at least 137p per share, or 85% of IWG’s recent market cap. The remaining business could be worth 600p per share.

The full session is available exclusively to members of MOI Global.

Members, log in below to access the full session.

Not a member?

Thank you for your interest. Please note that MOI Global is closed to new members at this time. If you would like to join the waiting list, complete the following form:

About the instructor:

Simon Caufield is Managing Director at SIM Limited, a UK-based investment firm. Simon founded the firm in 2007 after selling his stake in Nomis Solutions, a B2B enterprise software company he founded in 2002. His circle of competence is deep value, cyclicals and deceptively cheap compounders amongst the industrial and consumer discretionary sectors.

Previously, Simon was a management consultant for more than a decade, including at Mercer Management Consulting. Simon has an MA in Engineering from Cambridge University and an MBA from London Business School.

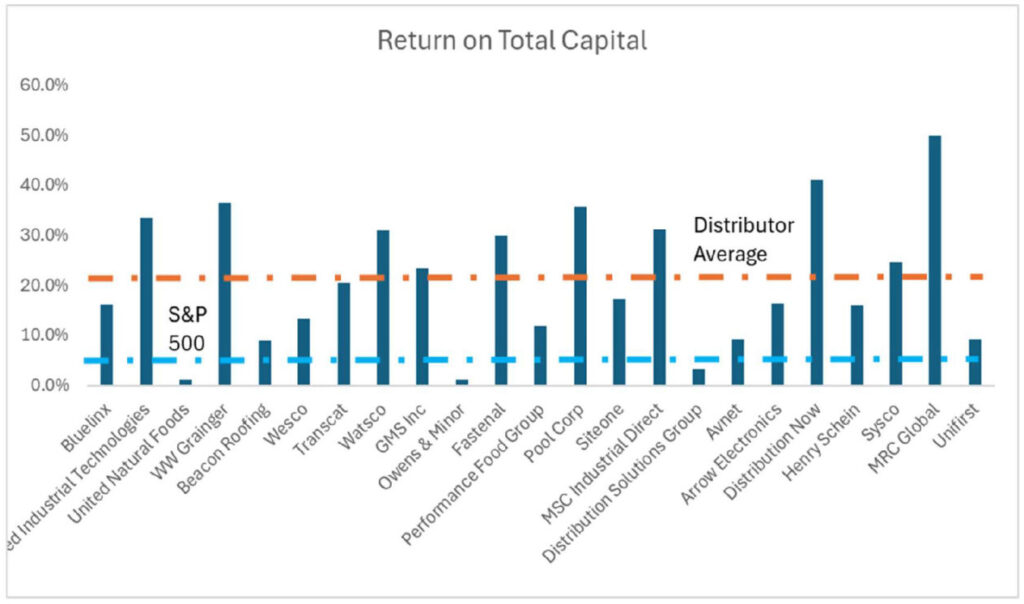

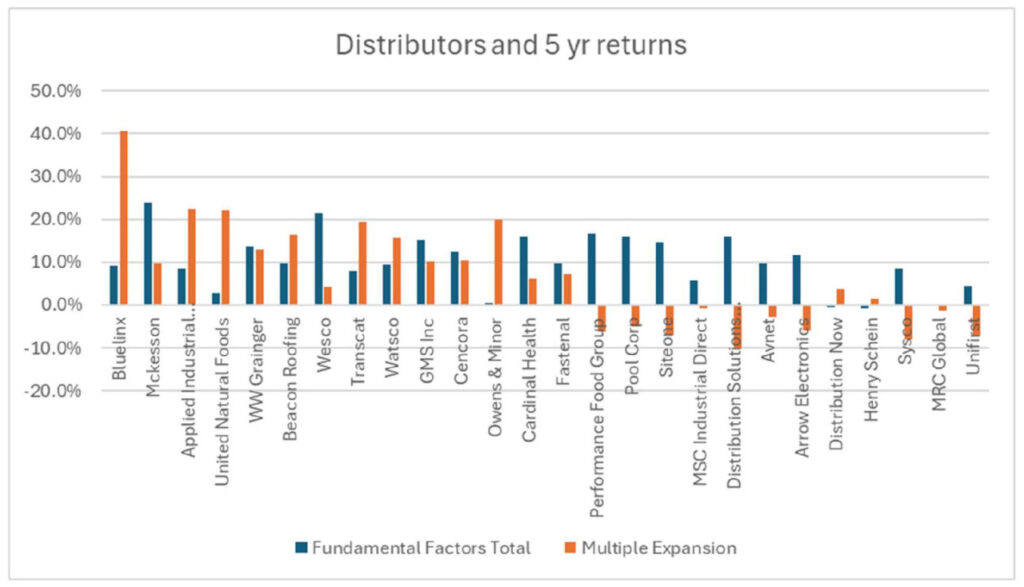

Source: Bloomberg, Firebird Value Advisors Research

Source: Bloomberg, Firebird Value Advisors Research